Presented by the Cambridge Centre for Risk Studies and AIG Research Teams.

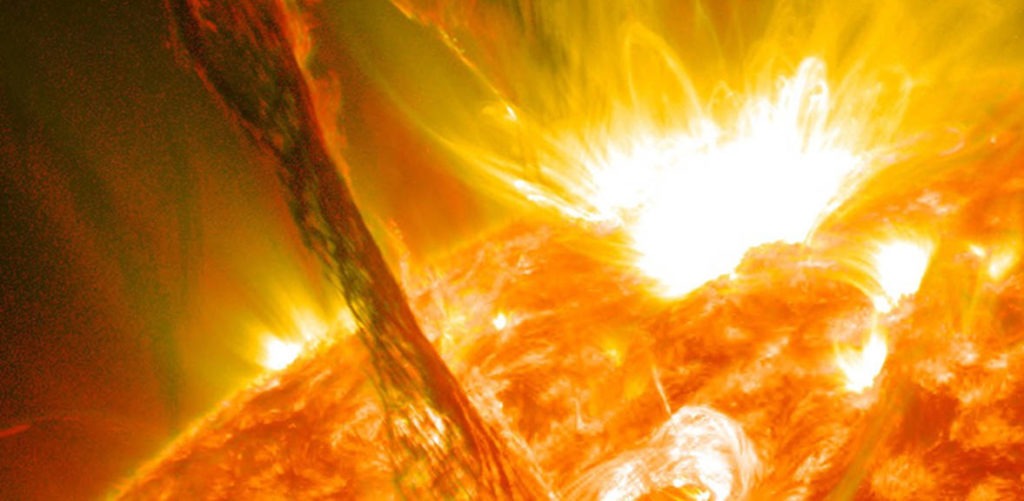

The Cambridge Centre for Risk Studies (CRS), in collaboration with the American International Group (AIG), invites you to our next London Risk Briefing. Following the recent release of the Helios Solar Storm Scenario Research Report to the stress testing community, the research teams at CRS and AIG will present the science behind the analysis and discussion.

The Centre’s new stress test, Helios Solar Storm Scenario, examines the potential business and industry impacts of an extreme space weather event affecting Earth. The scenario’s subsequent power-loss amongst value-added activities in the United States is estimated between $220 billion to $1.2 trillion across scenario variants. The study finds that the total direct after- shock of the storm may give rise to consequential market disruption with the manufacturing and financial insurance sectors most negatively impacted.

Briefing agenda

|

Time |

Session |

|---|---|

|

13:30-14:00 |

Registration & coffee |

|

14:00-14:10 |

Introductions |

|

14:10-14:30 |

Perspectives on Solar Storm Risks |

|

14:30-14:50 |

Introduction to Space Weather & the Ground Effects of Extreme Events |

|

14:50-15:40 |

Helios Solar Storm Research Findings The Helios Scenario & Critical National Infrastructure and Macroeconomic Impacts Insurance and Investment Portfolio Losses |

|

15:40-16:10 |

Coffee break |

|

16:10-16:50 |

Panel discussion: Industry commentary, applications, and business decisions Moderator: Fabrice Brossart, AIG Panellists:

|

|

16:50-17:00 |

Summary |

|

17:00-18:00 |

Networking reception |

Note: Programme subject to change

Brad Fischtrom

Chief Risk Officer, Commercial Insurance, AIG

Brad Fischtrom is the Chief Risk Officer for AIG’s Commercial Insurance business. He is accountable for design and facilitation of AIG’s Enterprise Risk Management (ERM) framework across the firm’s global Commercial Insurance operations and legal entities, including the effective management of all key insurance, market, credit, operational, and strategic risks. Since joining the company in May, 2010, Brad has led several diverse ERM teams and initiatives, covering AIG’s stress testing and scenario analysis process, risk aggregation, and management of AIG’s risk officers stationed within the Americas region.

Brad’s background represents all aspects of ERM, with particular focus in the areas of economic capital / risk modeling, risk governance, catastrophe risk management, and operational risk management. He also has substantial experience in Property Casualty (PC) insurance underwriting, broking, and actuarial science. Prior to AIG, Brad has held positions within Willis Towers Watson’s risk management consulting unit and at Aon Risk Services. He is a frequent speaker at industry conferences.

Brad holds a Bachelor of Science degree in Finance and Business Administration from the University of Richmond. He is a Chartered Property Casualty Underwriter (CPCU) and an Associate in Risk Management (ARM).

Professor Daniel Ralph

Academic Director, Cambridge Centre for Risk Studies, University of Cambridge Judge Business School & Professor of Operations Research

Professor Daniel Ralph is a Founder and Director of the Centre for Risk Studies, Professor of Operations Research at Cambridge Judge Business School, and a Fellow of Churchill College.

Daniel received his PhD in 1990 from the University of Wisconsin Madison. He was a faculty member of the Mathematics & Statistics Department at the University of Melbourne before coming to Cambridge University for a joint appointment in the Engineering Department and Cambridge Judge Business School.

Daniel’s research interests include optimisation methods, equilibrium models for electricity markets, and risk in business decision making. He is Editor-in-Chief of Mathematical Programming (Series B).

Simon Ruffle

Director of Technology Research, Cambridge Centre for Risk Studies

Simon’s responsibilities include managing research in the Centre, particularly the TechCat track – solar storm and cyber catastrophe research, and the Cambridge Risk Framework, a platform for analysing multiple global systemic risks through unified modelling software; a common database architecture and information interchange standards.

He is responsible for developing and maintaining partnership relationships with corporations, governments, and other academic centres. He speaks regularly at seminars and conferences.

He is developing methods for storing and applying the Centre’s Stress Test Scenarios and other Risk Assessment Tools to macro-economic analysis, financial markets and insurance loss aggregation. He is researching how network theory can be applied to understanding the impact of catastrophes in a globalised world, including supply chains, insurance and banking.

Originally studying architecture at Cambridge, Simon has spent most of his career in industry, developing software for natural hazards risk. He has worked on risk pricing for primary insurers, catastrophe modelling for reinsurers, and has been involved in placing catastrophe bonds in the capital markets. He has many years of experience in software development, relational databases and geospatial analysis and has worked in a variety of organisations from start-ups to multinationals.

Dr Andrew Coburn

Director of External Advisory Board, Centre for Risk Studies

Andrew Coburn manages the External Advisory Board of the Centre for Risk Studies, coordinating the inputs of consumers of research into the Centre’s risk agenda. Andrew is the principal coordinator of the research programme on ‘System Shock’ at the Centre.

Andrew is one of the leading contributors to the creation of the class of catastrophe models that over the past 20 years has come to be an accepted part both of business management in financial services and of public policy making for societal risk. He has extensive experience in developing models and using them for business decision support. Andrew has also provided research inputs into government policy, such as House of Congress legislation on terrorism risk management policy and urban planning for disaster mitigation in Mexico, Metro Manila, and Southern Italy.

Dr Andrew Coburn is a member of the senior management of Risk Management Solutions, the leading provider of catastrophe risk models to the insurance industry.

Jennifer Copic

Research Assistant, Centre for Risk Studies

Jennifer Copic is a Research Assistant at the Centre for Risk Studies. Jennifer supports the research on financial and organisational networks. She is particularly excited to work with tools that help visualise complex data sets. She holds a BS in Chemical Engineering from the University of Louisville and a MS in Industrial and Operations Engineering from the University of Michigan.

Prior to joining the Centre for Risk Studies, Jennifer worked as a systems engineer for General Mills at a manufacturing plant. She really enjoys modelling and visualising data in order to help others make more informed decisions.

Dr Edward J Oughton

Research Associate, Centre for Risk Studies

Dr Edward J Oughton leads the Risk Centre’s research into the management of critical infrastructure failure.

Edward has worked as part of the EPSRC-funded Infrastructure Transitions Research Consortium (ITRC) since 2012, where his thesis developed models for understanding the factors driving investment in fixed and mobile broadband markets. He is now leading the digital communications modelling work with Dr David Cleevely CBE on the EPSRC-funded project entitled Multi-scale InfraSTRucture systems AnaLytics (Mistral). Edward works closely with ITRC colleagues from the University of Oxford and is a visiting researcher at the School of Civil Engineering & Geosciences at the University of Newcastle.

Edward was previously a Senior Risk Researcher at the Cambridge Centre for Risk Studies working with Professor Daniel Ralph. He still leads the Centre’s research into the management of critical infrastructure failure. As a doctoral researcher he was President (2014) and Treasurer (2013) of Clare College Graduate Society, sitting on Governing Body, College Council and the Finance Committee.

Fabrice Brossart

Chief Risk Officer, AIG Europe

Fabrice Brossart is the Chief Risk Officer for AIG Europe and oversees AIG’s risk function in entities outside of the US and Japan, ensuring these operations have a risk management system proportionate to their exposures and in line with local regulatory and corporate governance requirements.

Fabrice leads the Internal Model Approval Process of AIG Europe which operates via branches in 26 European countries and is the second largest UK non-life company by capital. Fabrice joined AIG in February 2011 as Chief Actuary for the European region, subsequently taking additional responsibilities for risk management and leading the Solvency II programme. Between 2014 and 2015 Fabrice worked in a number of risk management roles at the AIG head office in New York.

A French national, Fabrice qualified as an actuary in France in 1997 and in the UK in 2001. Previous employers include AXA Insurance UK and Willis Towers Watson.

Niklas Niemann

Engagement Manager, McKinsey & Company

Niklas joined McKinsey & Company as an Experienced Hire in April 2014. He is part of the Global Energy & Materials Practice, with focus on EPNG and Renewables. Before joining McKinsey & Company, from 2010 to 2014, Niklas was member of the Strategy & Corporate Development Department at RWE AG in Essen, a leading German utility. His focus was power generation and portfolio strategy, in particular renewable generation. Prior to that, Niklas was the Executive Assistant to the CTO at HSE / Entega AG, a municipality-owned utility in Germany. Niklas holds a PhD in Mathematics from the University of Technology, Darmstadt.

Mark Clilverd

Senior Scientist, Space Weather and Atmosphere Team, British Antarctic Survey

Mark A. Clilverd has a BSc in Physics, a Doctorate in Space Plasma Physics, and over 25 years research experience while working for the British Antarctic Survey. He has many years of experience in working in polar climates with more than fice years service in the Antarctic, and 15+ visits to the Arctic. Between 2000 and 2014 he was the BAS lead investigator for several Space weather grants, including an EU FP7 project PLASMON, Antarctic Finding Initiative grants, and Responsive Mode NERC grants.

Mark has a special interest in the development, installation, and scientific exploitation of radio-wave propagation experiments, in particular their use for remote sensing of Space Weather. In 2005 he developed the Antarctic-Arctic Radiation-belt Dynamic Deposition VLF Atmospheric research Konsortium (AARDDVARK), along with Prof Craig Rodger of University of Otago, New Zealand. The network of instruments spans the Arctic and Antarctic and currently comprises more than 20 operational sites.

Mark has also worked on the impact of space weather on the Earth’s climate system, with particular emphasis on the chemical changes induced in the upper atmosphere as a result of energetic particle precipitation from geomagnetic storms. The work in this field has recently lead to energetic electron precipitation being included in the solar forcing terms for the Coupled Modelling Intercomparison Project phase six in preparation for the next IPCC report. He has active collaborations with researchers from Australia, Brazil, Canada, Finland, Hungary, Italy, Japan, New Zealand, Norway, South Africa, Spain, UK, USA.

Philip Brice

Manager, Corporate Risk Management, BP Treasury

Philip Brice is the Corporate Risk Manager within BP Treasury. His responsibilities include FX risks across the group, and forecasting the impact of factors such as market volatility on corporate cashflows and on the balance sheet.

He was previously Manager of Equity Capital Markets. Prior to that he spent over 20 years in engineering, R&D and management across all segments of BP.

Philip holds an MSc in Finance from London Business School, an MEng in Chemical Engineering from the University of Cambridge and is a certified ERP.

The Cambridge Centre for Risk Studies

The Centre has been established to advance the areas of science that inform the decisions made by government policy-makers, company risk managers, and other institutions and individuals faced with risks of low probability and high consequence. The Centre for Risk Studies serves the public and private sectors by providing fundamental research, exploring creative breakthroughs for risk management decision strategies, and creating a career path for researchers emerging from the University.

American International Group

American International Group (AIG) is a leading international insurance organisation serving customers in more than 130 countries and jurisdictions. AIG companies serve commercial, institutional, and individual customers through one of the most extensive worldwide property-casualty networks of any insurer.