Management Practice Professor of Finance

Fellow of St Catharine’s College

MA (University of Cambridge), MPhil (University of Oxford), PhD (University of London)

My research interests include economics and financing of energy infrastructure, especially nuclear power. I was previously Deputy Head of European Equity Research at JPMorgan where I had responsibility for the technical and quantitative research teams and the technology, media, and telecoms sectors. I’m also a Fellow in Management at St Catharine’s College, where I am a member of the investment committee.

I’m part of the Finance subject group at Cambridge Judge Business School, and the Cambridge Energy Policy Research Group.

Professional experience

Simon spent 9 years as an equity analyst at a number of investment banks, including BZW, JPMorgan and Citigroup, where he was involved in several major equity transactions and takeovers and led research teams covering the European and global utilities sectors. In 2001 he became Deputy Head of European Equity Research at JPMorgan where he had management responsibility for the technical and quantitative research teams and for the technology, media and telecoms sectors. He was a leading member of the team that set up JPMorgan’s global research centre in Mumbai, India in 2003. He has been a consultant to a number of hedge funds and the London Stock Exchange and has regularly taught on the JPMorgan European equities training programme.

Previous appointments

Simon was the first Director of the Business School’s Master of Finance programme (from 2006 to 2018), and was Deputy Director of Executive Education at Cambridge Judge (from October 2014 till September 2016).

From 2016 to 2018, Simon was a Visiting Professor at the China Centre for Energy Economics at Xiamen University in China. He was an Honorary Visiting Fellow of Cranfield School of Management in 2005 and 2006. He was previously a joint college lecturer in economic theory at St Catharine’s and Girton Colleges, University of Cambridge. He has been an economics tutor at Exeter College, Oxford University, and has taught development finance at the National University of Lesotho. In February 2007 he was Scholar in Residence at the Sigmund Weiss School of Business at Susquehanna University, Pennsylvania.

Publications

- Selected publications

- Journal articles

- Books, monographs, reports and case studies

- Book chapters

- Working papers

Selected publications

- Taylor, S. (2016) The fall and rise of nuclear power in Britain: a history. Cambridge: UIT Cambridge.

- Taylor, S. (2010) “Nuclear power and deregulated electricity markets: lessons from British Energy.” In: Leveque, F., Glachant, J.-M., Barquin, J., von Hirschhausen, C., Holz, F. and Nuttall, W.J. (eds.) Security of energy supply in Europe: natural gas, nuclear and hydrogen. Cheltenham: Edward Elgar, pp.155-166.

- Nuttall, W.J. and Taylor, S. (2009) “Financing the nuclear renaissance.” European Review of Energy Markets, 3(2): 187-202

- Taylor, S. (2009) “The changing role and regulation of equity research.” In: Gardner, C. (ed.) Qfinance: the ultimate resource. London: Bloomsbury, pp.301-302.

- Taylor, S. (2008) “How should investors value nuclear liabilities?” Cambridge Judge Business School Working Papers, No.04/2008. Cambridge: University of Cambridge.

- Taylor, S. (2007) Privatization and financial collapse in the nuclear industry – the origins and causes of the British Energy crisis of 2002. London: Routledge.

Journal articles

- Nuttall, W.J. and Taylor, S. (2009) “Financing the nuclear renaissance.” European Review of Energy Markets, 3(2): 187-202

Books, monographs, reports and case studies

- Taylor, S. (2016) The fall and rise of nuclear power in Britain: a history. Cambridge: UIT Cambridge.

- Taylor, S. (2007) Privatization and financial collapse in the nuclear industry – the origins and causes of the British Energy crisis of 2002. London: Routledge.

Book chapters

- Taylor, S. (2023) “Can nuclear attract green finance?” In: Lehner, O.M., Harrer, T., Silvola, H. and Weber, O. (eds.) The Routledge handbook of green finance. London: Routledge, pp.374-390

- Taylor, S. (2020) “How will the Belt and Road Initiative be financed?” In: De Cremer, D., McKern, B. and McGuire, J. (eds.) The Belt and Road Initiative: opportunities and challenges of a Chinese economic ambition. London: Sage, pp.319-343

- Taylor, S. (2010) “Nuclear power and deregulated electricity markets: lessons from British Energy.” In: Leveque, F., Glachant, J.-M., Barquin, J., von Hirschhausen, C., Holz, F. and Nuttall, W.J. (eds.) Security of energy supply in Europe: natural gas, nuclear and hydrogen. Cheltenham: Edward Elgar, pp.155-166

- Taylor, S. (2009) “The changing role and regulation of equity research.” In: Gardner, C. (ed.) Qfinance: the ultimate resource. London: Bloomsbury, pp.301-302

Working papers

- Nuttall, W.J. and Taylor, S. (2008) “Financing the nuclear renaissance.” Electricity Policy Research Group Working Papers, No.EPRG 0814. Cambridge: University of Cambridge.

- Taylor, S. (2008) “How should investors value nuclear liabilities?” Cambridge Judge Business School Working Papers, No.04/2008. Cambridge: University of Cambridge.

- Taylor, S. (2008) “Nuclear power and deregulated electricity markets: lessons from British Energy.” Electricity Policy Research Group Working Papers, No.EPRG 0808. Cambridge: University of Cambridge.

Awards and honours

- Joint Winner, Sandra Dawson Research Impact Award (for his work on nuclear power), University of Cambridge, 2017

- Pilkington Prize for Excellence in Teaching, University of Cambridge, 2009

News and insights

Student and alumni news

Innovating together in UK-China relations: the Cambridge China Business Forum 2024

The conference on 11 September is the inaugural Cambridge China Business Forum, a new student-led event aiming to advance collaboration between the UK and China.

Programme news

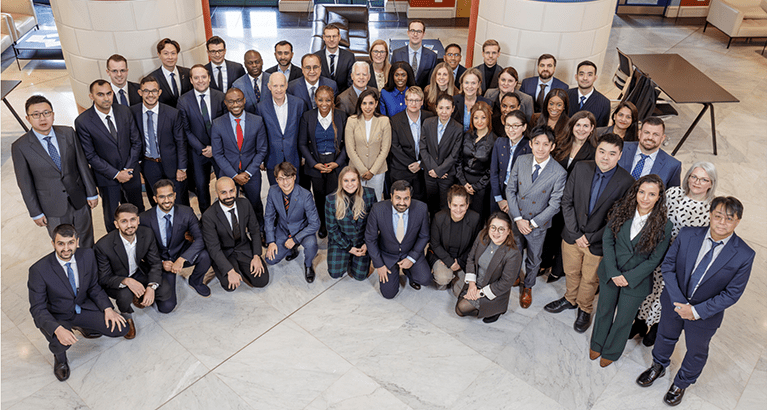

Global Executive MBA programme begins at Cambridge Judge

Cohort of 46 students joins first Global Executive MBA programme, representing 22 countries and with an average work experience of 14 years.

Programme news

New Global EMBA offered at the University of Cambridge

Cambridge Judge Business School, University of Cambridge, launches an exciting addition to its degree programmes – the Global Executive MBA – combining the richness of the Cambridge experience with teaching blocks off-campus, live online and in other countries.

Media coverage

Renew Economy | 10 March 2021

Ten years on from Fukushima, nuclear power continues to struggle with deeper problems

Dr Simon Taylor, Faculty (Professor level) in Management Practice (Finance) at Cambridge Judge, comments on nuclear power in relation to the 10th anniversary of Fukushima nuclear disaster. “The history of nuclear power is something of a rollercoaster from inflated claims and optimism to disillusionment,” said Dr Taylor. “But the main reason is not a shift in public opinion following Fukushima, with attitudes remaining surprisingly favourable in the UK. The problem with new nuclear remains economic: it costs too much to build.”

Financial Times | 10 September 2020

Letters: Climate change risk will challenge even ESG funds

Dr Simon Taylor, Faculty (Professor level) in Management Practice (Finance) at Cambridge Judge Business School, writes in a letter to the Financial Times that climate change will challenge even investment funds focused on environmental, social and governance (ESG) issues.

The Spectator | 26 June 2020

Is nuclear power the answer to climate change?

Dr Simon Taylor Faculty (Professor level) in Management Practice (Finance) at Cambridge Judge Business School, was one of the panellists on a podcast discussing about nuclear power in the UK, the Hinkley Point power plant, energy policy and more.

Financial Times, 19 August 2019

Letters: Overuse dulls the impact of a vigorous figure of speech

Daily Nation, 24 June 2019

Infrastructure projects most profitable

Korea Economic Daily, 7 October 2018

Nuclear power

China Global Television Network, 27 September 2018

China’s economy is driven by consumption