Silicon Fen: Europe’s unicorn capital

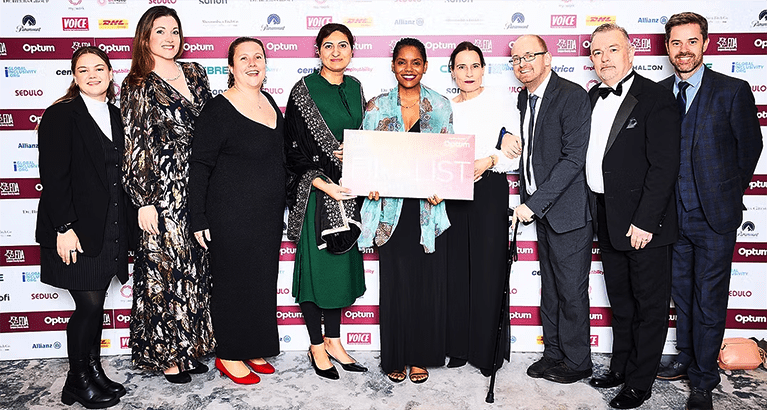

Image: Josh Neely (left) and Ben Saward (right).

Nestled in the heart of the UK’s Silicon Fen, Cambridge is a globally recognised hub of entrepreneurship and investment. In 2023, it was affectionately referred to by the Financial Times as the “Unicorn capital of Europe”, with 23 Cambridge-born privately held startups individually valued at over $1billion. For entrepreneurs, institutions such as the University’s Hauser Forum, or Cambridge Judge Business School (whose alumni include Raspberry Pi CEO Eben Upton and Gousto founder Timo Boldt) represent excellent opportunities to integrate into a culture of innovation and success.

Ben Saward (EMBA 2021) and Josh Neely (EMBA 2021) are some of our latest students to launch an entrepreneurial venture following an EMBA, with their succession fund Novi GP recently securing financial backing from leading global family offices. We spoke to Ben and Josh, who met on the EMBA, about entrepreneurship, their Executive MBA experience, and how the Cambridge difference can open doors in a world built on venture capital and entrepreneurial networks.

A cyclical culture of innovation and niche sector exploration

“You are surrounded by entrepreneurs in Cambridge, and you’re also surrounded by academics who work closely with entrepreneurs”. This almost cyclical setting, Josh Neely describes fosters a culture of taking risks and doing “something bold”, which Ben Saward reports he definitely felt throughout the programme, not just from academics and faculty, but also from his peers. Being in Silicon Fen and being surrounded by aspirational, complex businesses, was an eye-opening experience to the horizons that exist in terms of industries and sub industries within Cambridge’s impressive ecosystem of businesses. “It’s a unique place”, they assure us, which is not focused around solely finance or tech, despite its reputation for excellence in these areas: it is a full ecosystem.

You are surrounded by entrepreneurs in Cambridge, and you're also surrounded by academics who work closely with entrepreneurs

Entrepreneurship through acquisition: a catalyst for Novi GP’s model

Given how pivotal both Cambridge and its EMBA environment have been to Novi GP’s early success, Ben and Josh say they’ve gained a deep understanding – and awareness – of the many niche sectors in this unique ecosystem.

They cite modules taken on the programme as seminal to their current understanding and directionality – specifically, during EMBA electives week, a course run by Yasser Nasser on entrepreneurship through acquisition, which they both took.

The ETA module proved extremely useful for their future joint enterprise, not only setting the scene for “several late-night chats on the nature of UK acquisition”, but also because it was a course built specifically on fostering an understanding of acquiring a business and also then operating said business,. “Not purely from a private equity standpoint” (solely investing in businesses) but the combination of investing and then operating – the crux of Novi GP’s current offer, providing reassurance for legacy businesses that their brand identity and core identity will not be diluted, as it often is in other acquisition contexts.

As a result, when thinking about their approach to Novi growth partners, it was these lectures and accompanying coursework that allowed them to engineer strategies that they later went on to implement in their current business model, all while completing varied other modules on business management and organisation.

From EMBA classroom insights to venture strategies

This breadth of learning is another core feature that Cambridge offers, reflected in the diversity of the surrounding business environment – and, as Ben states, “the true value in business comes from those creating value through operational work, it’s the operators that really create the value within the business”. Therefore honing this awareness, this education, within this context, in a place where diversity of thought, value creation and operational expertise is even more important is a priceless commodity for an entrepreneur. And Cambridge “definitely stands of head and shoulders above other universities when it comes to supplying that within its MBA programme and its cohort”.

The other massive advantage of this cohort diversity, both in background and business, is the breadth of networking potential that consequentially exists, localised within Cambridge Judge Business School. “Connections are probably one of the biggest benefits of doing the Executive MBA at Cambridge”, Josh affirms.

From academics who are familiar with the models and practices they have gone on to employ (and therefore afforded them “time to talk through it and bounce ideas off each other”) to the course content itself, providing insights into what family offices are looking for specifically in their investments, so much of the basis for Novi GP could be said to stem from the EMBA network and infrastructure. Providing a diverse and valuable set of views and feedback loops, other members of our cohort were also a fantastic resource, “having each other throw stones at our ideas and really trying to poke holes and see how we can improve things” in an incubator-like setting.

Finally, being surrounded on the EMBA by business owners, “people that have built their own organisation from scratch” supplied a wealth of experience in entering the sector. As Ben states, “as individuals or as a fund that are trying to acquire a business, it’s interesting to know how owners think about their businesses and what challenges they have when they think about selling their business, whether it’s about wanting to preserve legacy and therefore avoid more traditional acquirers, it’s helped us tailor our approach and try and launch a differentiated value offering in the market.”

the true value in business comes from those creating value through operational work, it's the operators that really create the value within the business.

Learning to lead together: a shift from solo to shared entrepreneurship

Although Ben and Josh came from different business backgrounds, their complementary skills and shared entrepreneurial aspirations were nurtured – and fully developed -throughout the EMBA journey.

Josh was a stand-alone entrepreneur before, now a part of an entrepreneurial partnership, and shares that a core learning of the EMBA, was collaboration. “As a team you are stronger, and that was instilled from the first day of the programme and throughout it, and we saw the benefits through multiple exercises, games and management practise in particular which really brought that to the fore”.

“Collaborating as a wider team is where you can really get the most value out of an organisation, and of course with what Ben and I are doing now”, Josh concludes. “I’ve moved from being a solo entrepreneur to being a partner entrepreneur, and more than that, we have partnered with family offices as well, so we’re very much seeing the benefits of collaboration and the wider team dynamics”.

“There is that incredible network that comes with the EMBA at Cambridge, which we’ve been able to learn from but also leverage and support as well.” Having connected with people who are doing either similar things to us or learning from tangential entrepreneurial journeys, has been so useful in helping us think through some of the challenges which occur throughout the entrepreneurial journey.”

Executive MBA programmes

The Cambridge Executive MBA and Global Executive MBA are 20-month programmes for senior executives who want to apply their knowledge and skills as they learn.