Purpose isn’t what you stack up; it’s what you spark. Cambridge taught me that the real win is lighting others up, knowledge gets you anchored, connection keeps you scaling.

It’s been exactly a month since I moved back to Dubai after my year at Cambridge and the first words on everyone’s lips when they see me is the usual’ “How was Cambridge?!” I had already developed a smooth script about how eye opening and humbling the experience was, but it wasn’t until I was providing guidance and sharing my experience, with a student who just accepted his place in the MBA 2026 class, that I did some deep retrospection about the impact of my MFin year. It was a one-year sprint that helped me develop a way of thinking that stands up in the real world. Three things changed most for me: my finance toolkit, my way of connecting and how I lead.

My finance toolkit

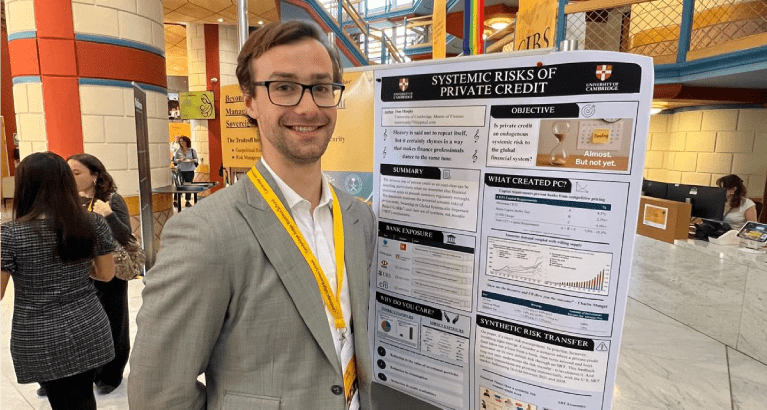

The skill to correctly make buy or sell decisions on stocks has made the fortunes of some of the most prominent people in the finance industry. I had always been curious to understand the process (outside the romanticised ways it is portrayed in the news). The Equity Research Project (ERP), where I had to determine the true value of Procter & Gamble (P&G), helped bring a practical feel to the classroom teachings. I was able to link numbers to reality, tie enterprise value to the drivers that move unit growth, understand pricing power in an inflationary world, FX volatility and working-capital choices. While I can build a DCF and analyse comparables faster now, the bigger shift is judgment. Setting sensible ranges, naming the few assumptions that matter and showing what factors change the decision

The weekly City Speaker sessions provided a more human feel to Finance. Hearing C-Suite and senior management speak plainly about their journeys, their triumphs and most importantly, how they dealt with setbacks made it more tangible. Understanding the different personalities of these successful people and seeing what made them tick in their different roles was priceless. Their process of decision-making provided a template for assessing risk. I now ask, what could go wrong, how soon would we see it and what would we do next?

The Stablecoin Advisory project for an Italian Bank for the Group Consulting Project (GCP) took that mindset into the world of digital finance. We filtered hype from real use cases, mapped current processes and Anti-Money Laundering (AML) flows, thought through custody and corridor selection and designed a phased pilot that reimagined the Bank’s remittance process, but protected the core business. This taught me to pair innovation with controls, so that change lasts.

My way of connecting

The problem most people have with networking is that they are too focused on connecting “upwards”, they don’t realise they are around greatness in its nascent form. Cambridge taught me to treat networking as a service, not a transaction. Having a genuine interest in the stories and aspirations of my peers allowed this to happen. I learnt the ability to break communication barriers with a smile and to understand that the person on the opposite side is probably more anxious, but excited to make the connection. The City Speaker Series became a weekly masterclass in asking sharp questions, landing a 2-line follow-up and turning a good conversation into a one-to-one. I built a simple system when interested in furthering the relationship: same-day thank-you, then a follow-up weeks after. That give first habit made relationships warmer and provided benefits till this day.

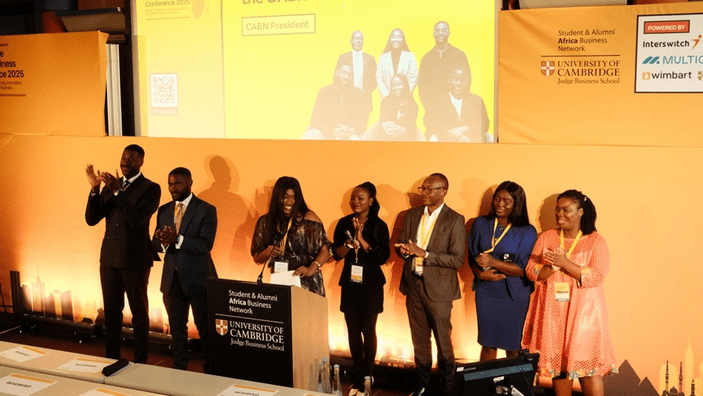

The crowning jewel of my stay at Cambridge was hosting the Cambridge Africa Business Conference (CABC). This pushed me out of my comfort zone. I was the Co-Chair of the Society and I took the lead on Finance and Sponsorships. Believe me, the 3 outright ‘no’s’, 7 diplomatic ‘no’s’ and the 2 coldly ignored messages just fuelled the passion to make sure the event was successful (this made me realise I may have a future in sales). Through the preparation, I learned the difference between advisors and sponsors and how to earn both: show up prepared, do the unglamorous work and close the loop on advice you’re given.

The goal was to ensure the bold stories of leading Africans in finance, business and the arts were told in the halls of one of the most prestigious universities in the world. Shaping the perception of the continent and increasing the potential for representation was at the forefront of our minds. The conference was sold out and the feedback we received demonstrated the audience got their value for money. The power-packed panellists and keynote speakers provided great fuel and insights to drive the learnings home.

Representing Cambridge at the MBAT games at HEC Paris was another highlight of the year. We competed with the brightest minds from the top 15 Business Schools in Europe by day and created camaraderie with them by night over 3 intense days. I participated in the Spartan Race, tug of war, Steinholding and football, developing relationships within and around these competitions with teammates and opponents alike.

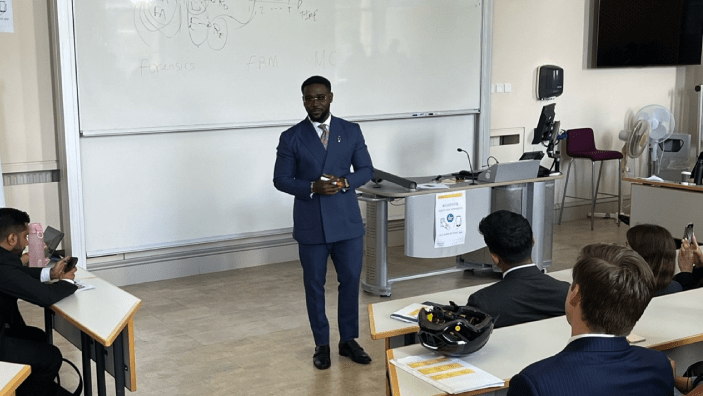

How I lead

I was elected as the Faculty Representative by my cohort and got to see behind the veil, understanding the business behind business schools. Taking wide-ranging feedback and turning it into practical fixes, that role taught me to listen, prioritise and negotiate diplomatically, while keeping an eye on the bigger picture.

Gym at the crack of dawn and learning golf reset how I handled pressure. I took on the side hustle to be a part-time personal trainer for a couple of my friends. There couldn’t be a better lesson on understanding different personalities, empathising with them and determining the approach to help them grow. I found it a transferable skill to building teams. Golf taught quick recovery, forgetting the bad shot and focusing on the next swing. ‘On to the next one’ was the motto, till the bad shots became less repetitive.

After all is said and done, the most memorable part of the MFin experience would be the numerous group projects which turned colleagues into friends. From examining Disney’s takeovers and identifying its cumulative abnormal returns, to the Procter & Gamble Equity Research Project, to the Walco credit decision, to the Private Equity assignment and finally the Group Consulting Project, all brought strong results based on each member contributing and playing to their strengths. Effective communication was definitely the cornerstone for the success of the projects, with everyone encouraged to contribute and speak freely.

Closing remarks

Cambridge itself is a teacher. The quiet Colleges, early morning runs across town and late-night strolls across different halls gave me space to think. The community challenged and supported in equal measure. I leave with sharper tools, a steadier way of working and a trusted lifelong network.

About the blog author

Ose is a Wealth Advisor based in Dubai. He focuses on turning complex private market investments into inclusive investment opportunities, advising High-Net-Worth Individuals (HNWIs) on private credit, private equity and litigation financing across the Middle East. Crafting strategies that fit each client’s goals and risk appetite, pairing rigorous risk discipline with real-world growth.

Before the MFin, he had worked for 9 years in strategy consulting, primarily in the financial services industry, advising some of the biggest commercial banks, development finance institutions, central banks, asset managers and pension fund administrators in multiple countries such as Egypt, Italy, Nigeria, Saudi Arabia, South Africa, Oman, the USA and the UAE.

In addition to the MFin, Ose is a qualified ACA and FRM.

Master of Finance

Engage with the world’s best financial minds and skilled professionals. Open doors to exciting new career possibilities with a Cambridge Master of Finance (MFin).