As financial players debate the wisdom of AI investment, a report on long-term market trends co-authored by Professor Elroy Dimson of Cambridge Judge Business School provides a timely reminder: investors should shun neither new nor old industries, and new tech doesn’t always produce bubbles waiting to burst.

Finance and accounting

Why biodiversity finance has become a big deal

Biodiversity finance is moving from a specialist sustainable‑finance topic to a core concern for investors, companies and policymakers. A new Special Issue of the Review of Finance on biodiversity and natural resource finance brings this emerging field into focus. Explore its main messages and takeaways from the key papers included.

Research centre news

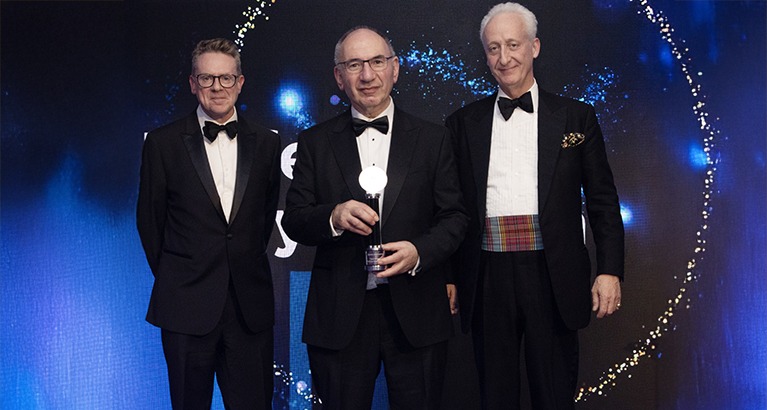

Honour for research on investor engagement

Paper by academics at the Centre for Endowment Asset Management at Cambridge Judge Business School is awarded Honourable Mention in the prestigious Moskowitz Prize for outstanding research on sustainable and responsible investing.

Research centre news

Global initiative to bridge finance and biodiversity

A global initiative devised by Cambridge Judge Business School and the Review of Finance is driving a new wave of high-quality research to address critical gaps in understanding how capital markets and financial economics can tackle biodiversity and natural resource challenges.

Research centre news

Does monetary policy affect individuals’ interest rates equally?

In theory, a direct way through which monetary policy is able to affect demand is through consumer credit rates. When a rise in the policy rate is passed-through to consumer credit rates, taking out a loan becomes more expensive and aggregate demand is suppressed. In new research, we use Brazilian credit registry data to examine whether this pass-through of monetary policy to consumer interest rates happens equally across all borrowers. Preliminary results suggest that monetary policy disproportionately affects credit costs for lower-income borrowers such that it increases the interest rate spread across the income distribution.

Research centre news

Foreign exchange markets symposium hosted by Cambridge Judge

Cambridge Judge Business School hosted scholars and practitioners involved in foreign exchange issues at the 2025 Symposium on Foreign Exchange Markets, which covered such topics as FX liquidity, risk management, central bank interventions and the impact of AI and digital currencies on currency markets.

Finance and accounting

Understanding market cycles through history, data and personal insight

Professor Elroy Dimson has for decades boosted our historical understanding of financial markets. He reflects on how he became hooked on financial data through an early sojourn into the corporate world, how markets history may judge artificial intelligence, and how his family’s wine business resonated in his research into collectibles.

The Lifetime Achievement Award from PAM Insights cites his work in research, teaching and for producing with academic colleagues an essential asset-returns database.

Stock market returns have been lower in the first quarter of the 21st century than the 20th century, but still had annualised real returns of 3.5%, says report co-authored by Professor Elroy Dimson.

Annual UBS Investment Returns Yearbook, co-authored by Professor Elroy Dimson of Cambridge Judge Business School, finds that Japan, Canada, Germany, Australia and other nations have lost stock market share to the US.

Finance and accounting

History shows inflation is stubborn when it hits 8%

Inflation hit decades-long highs in 2022, and easing is historically very slow from such levels, says new report co-authored by Elroy Dimson of Cambridge Judge Business School.

Top awards granted at the European Investment Forum organised by the Centre for Endowment Asset Management at Cambridge Judge Business School and FTSE Russell, a London Stock Exchange Group (LSEG) company.