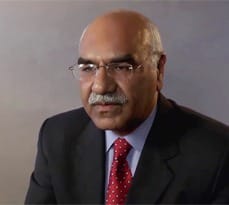

Dr Muhammad Amjad Saqib, Executive Director and Founder of Pakistan’s first and largest interest-free microfinance organisation, Akhuwat, says the ‘beauty’ of the whole microfinance movement disappeared as the banks moved in. Now the state should intervene with a code of practice.

Dr Saqib founded Akhuwat 12 years ago with $100 and has seen it grow to 250 branches with more than 370,000 borrowers.

He feels that the entire movement has been taken over by the banks in the name of sustainability, and is not surprised that over 80% of microfinance is now being provided by the banks.

In an interview for Cambridge Judge Business School’s website, Dr Saqib blames the rising number of suicides on the high interest rates (up to 40-50%, sometimes 200% in Latin American countries) now levied in the microfinance sector.

He feels the ‘beauty’ of a movement that began with an objective of providing a means of livelihood for a poor family has disappeared, and that the state and central banks should intervene with policies and stricter rules.

Money is being given people in the guise of poverty alleviation, and then pressure is built on them to the extent that they cannot unlock their potential and cope with the situation, he adds.

“The state must intervene. State must ensure a proper environment, proper legal structure. The customers and the clients also have rights. So the state should ensure that all the actors, all the stakeholders – whether banks, NGOs or MFIs – should have a code of practice that should be strictly monitored.”

Dr Saqib’s Akhuwat aims to alleviate poverty by empowering socially and economically marginalised segments of the society, and in the process harnessing their entrepreneurial potential.

Its business model is unique, distributing loans from mosques and churches to create an avenue for transparency, community participation and awareness while at the same time cutting organisational costs.

“We have been able to prove that this financial and social intermediation could be undertaken on the basis of generosity and altruism. If a programme which is based on commercial interest is sustainable, then why should a programme based on mutual respect and altruism not be sustainable?”

Akhuwat envisions a society built on the principles of compassion, brotherhood and equity. It offers an important example of an efficient but non-commercial approach to microfinance.

Dr Saqib was interviewed by Dr Kamal Munir, Reader in Strategy & Policy at Cambridge Judge Business School.