New tool provides everyone with insights into the digital money landscape

The Cambridge Centre for Alternative Finance, part of Cambridge Judge Business School at the University of Cambridge, has launched a new open-access digital tool, the Cambridge Digital Money Dashboard. The dashboard provides policymakers, financial authorities, industry professionals and the general public with a trusted and comprehensive source of digital money data and educational content. With real-time datasets and interactive visualisations, it provides greater transparency and insights into the digital money landscape.

In its first release, the Cambridge Digital Money Dashboard focuses on stablecoins[1], covering the most prominent stablecoins that together constitute approximately 95% of the overall stablecoin market cap. Experiencing significant growth, the stablecoin market has surged from less than 3 billion USD in 2019 to more than 130 billion USD today.[2] This rapid expansion has been accompanied by several market events that have caused major depegs[3] in various stablecoins, prompting a heightened effort towards regulation and supervision.

To shed a light on the growth and development of privately-issued stablecoins (i.e. stablecoins not issued by a central bank or a public authority), the Cambridge Digital Money Dashboard provides empirical data on the increasing adoption of stablecoins (e.g. overall supply across chains, value and number of transfers, and velocity), analysis on the risks associated with the stablecoins (for example, peg stability and reserve composition) as well as insights on consumer/investor protection issues (for example, redemption rights and segregation of accounts) under various regulatory regimes.

The Cambridge Digital Money Dashboard is an open-access digital tool available for everyone to utilise and aims to inform market development as well as regulation and policymaking globally. The Cambridge Digital Money Dashboard’s data is updated regularly (in most cases hourly or daily via API) and scalable, with future updates to include expanded data on primary use cases of stablecoins and geography-related datasets.

3 key sections of the Cambridge Digital Money Dashboard

The first phase of the dashboard includes three sections: Digital Money 101, Adoption, Risks & Protections.

1

Digital money 101

To tackle the steep learning curve in digital finance, this section offers the general public an interactive guide to bridge knowledge gaps, presenting a clear, expertly-synthesised overview of the evolution of money and emerging digital money instruments. Its comprehensive glossary and definitions help simplify complex terminology, making digital money knowledge accessible to beginners and experts alike.

2

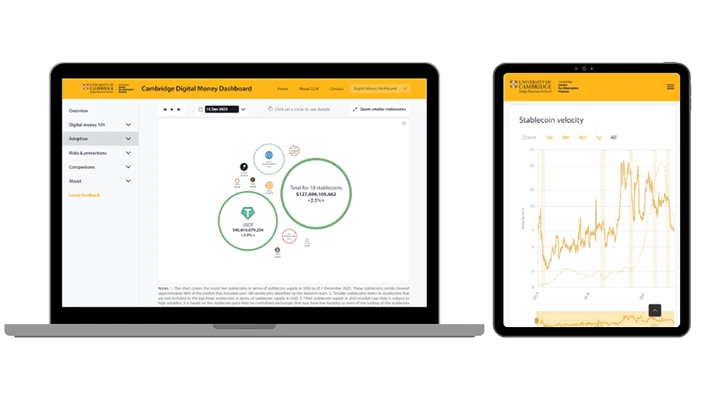

Adoption

Recognising the difficulty in tracking and understanding stablecoin adoption trends, this section provides industry professionals with near real-time data as well as user-friendly data visualisations and analytics to help inform their financial product offerings and payment infrastructures. Covering the most prominent stablecoins with cross-chain data, it enables users to discover some of the foundational adoption metrics such as aggregate stablecoin supply and value of transfers over time. The addition of velocity metrics helps users identify changes in stablecoin usage patterns during important market events, further highlighting stablecoin holders’ preferences during times of turmoil.

3

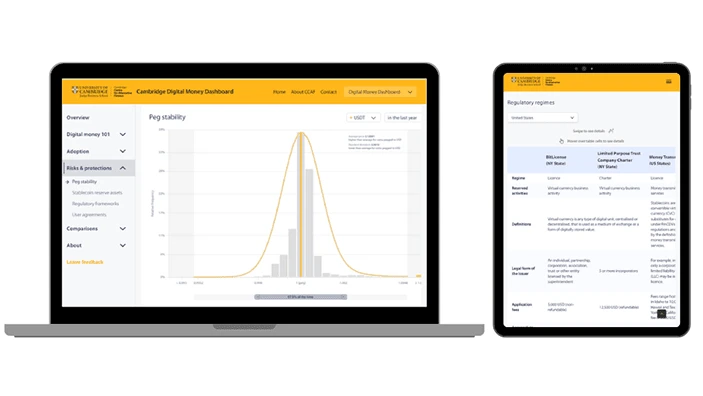

Risk and protections

Highlighting the inherent risks, this section explores the relative stability and reserve asset compositions of various stablecoins. Through the use of an intuitive histogram and a depeg calculator, financial professionals and stablecoin holders can discover how often and for how long a stablecoin spent outside of its peg. As most major stablecoins utilise reserve assets to back their stablecoins and achieve peg stability, the tool provides users with a breakdown on the reserve asset composition over time and information on significant stablecoin events such as a change in auditor. Given the diversity of stablecoin regulatory environments, industry professionals and regulators can get an overview of the four major regulatory frameworks (US, EU, UK, and Singapore) at a glance. Additionally, the table helps the general public to understand the protections that are foreseen by the law, and industry to identify the most favourable jurisdictions in which to launch products.

Reflections on the initial launch of the dashboard

The Cambridge Digital Money Dashboard addresses the need for a comprehensive and trusted solution that monitors the evolution of stablecoins and other emerging digital money instruments. It combines educational content, with high quality data sources, as well as information on risks and protection mechanisms, and aims to provide users with a nuanced perspective to the data by making comparisons with traditional finance. As the dashboard is extended to include a wider range of digital money assets and instruments in the future, we expect users to be able to bridge knowledge gaps, understand complex data interactively, and grasp the trends as well as the inherent risks of digital money.”

With the incredible growth and increasing adoption of stablecoins as well as the rapid development in CBDCs, tokenised bank deposits and cryptoassets, the landscape of digital money is changing before our eyes. The Cambridge Digital Money Dashboard aims to shed a light on that evolving, complex and fluid landscape, and underscores our continued efforts to inform evidence-based decision-making by leveraging the power of empirical data and collaborative research.”

The empirical data for the dashboard is sourced from various leading providers – including Lukka, Coinmetrics and Glassnode – and open sources, such as stablecoin issuer websites and legislative documents in select jurisdictions.

We are proud to help power Cambridge University's Digital Money Dashboard with our empirical data. This collaboration demonstrates our commitment to advancing the educational and practical understanding of digital assets. We are honored to support an academic institution of Cambridge's calibre in their education and research into digital assets and finance.

The Cambridge Digital Money Dashboard is a research output of the Cambridge Digital Assets Programme, a multi-year research initiative hosted by the CCAF in collaboration with 18 prominent public and private institutions. The Programme provides the datasets, digital tools and insights necessary to facilitate a balanced public dialogue about the opportunities and risks a growing digital asset ecosystem presents. The ultimate objective is to help inform evidence-based decision-making and regulation through open-access research.

CDAP’s founding institutional collaborators are (in alphabetical order) Bank for International Settlements (BIS) Innovation Hub, British International Investment (BII), Dubai International Finance Centre (DIFC), EY, Fidelity Investments, UK Foreign, Commonwealth & Development Office (FCDO), Goldman Sachs, Inter-American Development Bank (IDB), International Monetary Fund (IMF), Invesco, Mastercard, MSCI, Visa and World Bank. Four new members have recently joined the effort: NatWest, Switzerland’s State Secretariat for Economic Affairs (SECO), Euroclear and the Depository Trust & Clearing Corporation (DTCC). The CDAP Emergent Money Systems research stream is advised and co-chaired by Gina Pieters and Marcelo Prates.

One of the biggest questions we face over the coming years is what impact digital money, in all its possible forms, will have on commerce, society and our overall lives. CCAF’s Digital Money Dashboard is a first step in bringing insight and understanding to the digital money evolution.

Transparency of the backing to stablecoins is a priority of the BIS Innovation Hub. The Cambridge Digital Money Dashboard is a useful open-sourced tool, providing insights into historical trends and stability factors. We encourage further development of open-sourced tools in this space.

We are extremely proud to be working with the Cambridge Centre for Alternative Finance, providing insights and contributing to leading edge research with the objective of delivering solutions that will make the markets more efficient. As a financial market infrastructure, it is our role to foster an environment which helps produce innovative technology that will support the growth and stability of the capital markets.

At the time when the Bank of England and the FCA are consulting on stablecoins, it is great to have a tool that helps all stakeholders in the ecosystem understand, learn and also reflect on the data that is available on digital money.

Footnotes

[1] The term stablecoins is colloquially used to describe cryptoassets that purport to maintain a stable value against another asset or basket of assets, typically a fiat currency.

[2] Source: Cambridge Digital Money Dashboard, based on the data provided by Lukka Inc.

[3] The term depeg refers to the event when the value of a stablecoin (which is supposed to be fixed and stable and is often pegged to a currency like the US dollar) deviates from its target value.

Cambridge Centre for Alternative Finance

The centre is driven by its mission to create and transfer knowledge addressing emergent gaps in the financial sector that supports evidence-based decision-making.

Related content

The Cambridge Digital Money Dashboard , a new open-access digital tool policymakers, financial authorities, industry professionals and the general public, was launched in February 2024 by the Cambridge Centre for Alternative Finance.