We wake up every day on a planet that floats in a galaxy filled with billions of stars, in a universe filled with billions of galaxies, and yet, we disregard this simple truth in our socioeconomic constructs. Specifically, we seem to ignore our cosmic existence in two key social sciences, i.e. economics and finance.

In economics, the ontological premise of scarcity, and in finance, the disregard of space as a key analytical metric, leave our species ill-equipped to not only embark on the galactic adventure that life on planet Earth is really about, but also, put our planet in an unnecessary fight for survival due mainly to the damage that we unconsciously inflict on our home.

We are in the middle of billions of stars and billions of galaxies, and our economics preaches scarcity as a worldview, rewiring our cosmic instinct of prosperity.

Indeed, the currently popular austerity policies in the UK, Europe, and the United States are born from an ontological defeat vis-à-vis prosperity. This is so because scarcity is perceived as a determinant and ingredient of value, and is the founding principle upon which our modern money creation methodology rests.

Today, money, in cotton and linen form or zeros and ones, is created via debt and credit and expands through the same. Central banks invent the money in circulation by purchasing government-issued debt paper, more recently, bank-issued mortgaged backed paper. Indeed, money supply expands through the debt and credit contracts of public and private entities.

The debt-based logic of money creation, in the middle of an enormous and miraculous cosmos, chains our species to calendar time. Across this beautiful planet, floating in space, the number of governments, government agencies, municipalities, businesses, households, individuals, and corporations chained to calendar time payments is simply astounding.

Indeed, the scarcity of money, and its availability via debt, is part and parcel of the scarcity-based model of economics. This is a philosophical and scientific challenge, but it is bottom line an individual human awareness embracing a vast molecular cosmos.

Debt-based money chains the species to calendar time. As a species in cosmos, we must be able to invent money in a way that suits our evolutionary intentions and aspirations, without the artificial burden of debt.

Humanity must invent money in a way that allows it to invest as much as it needs in order to explore the evolutionary dimension it wants to pursue. Money can also be created through parallel alternative instruments, which lead to debt-free money mechanics. I have proposed that Public Capitalisation Notes (PCN), profit/asset sharing instruments without any debt component, can be used for money creation purposes. Thus introducing an equity like logic to money mechanics.

When issued by a government agency and/or sponsored by the Treasury, a PCN can be just as valid an instrument as a Mortgage Backed Security (MBS) for a central bank to use for their injection of new money. Public Capitalisation Notes, when used for new money creation, channel the money into the economy as income first, by directing investment into specific industries and projects, by creating value and assets from the beginning.

Nothing really prevents us from channelling new invented money into the UK Space Programme, for example, rather than the big banks, except a debt-based logic of money creation.

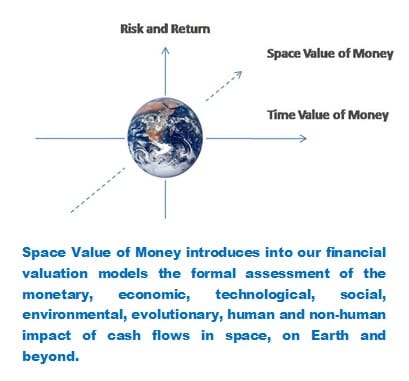

We must embrace this enormous molecular cosmos as our own true context, drop scarcity as a worldview, and introduce new principles of value based on abundance and creativity. Today, the finance discipline and industry use two key principles of value, 1) risk and return, and 2) time value of money. There is no reference to space. Furthermore, all financial models are geared towards analysing the profitability of cash flows, rather than their creative impact.

I have introduced a new and yet missing metric of financial valuation, Space Value of Money. Space Value of Money formalises the analysis of the space impact of cash flows and complements the discounting of future expected cash flows based on risk and time variables.

Indeed, what if we wanted to invest in a project irrespective of time, and irrespective of risk? What if we wanted to pierce the sky and explore this universe? Our economics and finance must not just serve the mortal investor fearful of time and risk, but also the immortal being whose footprints in the cosmos are our own responsibility.

© Photograph copyright by Nasa

Dr Armen Papazian earned his PhD in Financial Economics at Cambridge Judge Business School. He is the first winner of the Alpha Centauri Prize, the progenitor award. A world-known expert in Islamic Finance, he is a former stock exchange executive, investment banker, and academic, the founding CEO of the International Space Development HUB, and the Chairman and CEO of Keipr Ltd, a boutique financial modelling and consulting firm. He has numerous publications in a variety of outlets, acts as an advisor to numerous organisations, sits on a number of advisory boards, and is a sought after consultant and speaker.

Further reading and links

- Space Exploration and Money Mechanics: An Evolutionary Challenge by Armen Papazian, November 2012

- “Extraterrestrial etiquette: how should humanity interact with alien life?”, Space.com, 23 October 2013

- “NASA’s future in space”, USA Today, October 2013

- “How to achieve growth by printing money” by Armen Papazian (Bracken Column), The Banker FT, October 2011

- A Product That Can Save a System: Public Capitalization Notes by Armen Papazian (Sorbonne University Paper), October 2011