By Alba Patozi, PhD candidate, Faculty of Economics, University of Cambridge

In the context of the current high interest rate environment, senior central bankers such as Isabel Schnabel from the European Central Bank have pointed out that, despite the large upfront costs, green firms may not be as vulnerable to higher interest rates as previously expected. Her recent speech at the Symposium for Central Bank Independence suggests only a mild impact of rising borrowing costs on the Net-Zero transition and no evidence of funding shortages on green investments (Schnabel, 2023). In my research, I ask: Is this observation true more generally and across time? In other words, are green firms more or less responsive to monetary policy shocks? And if so, what explains their sensitivity (or lack thereof)?

To address these questions I use stock market, credit risk and investment data from a sample of US publicly listed firms, which spans the period between 2008 to 2021. To proxy for firm-level greenness, I collect environmental performance score data from MSCI ESG IVA Ratings. In its framework, MSCI considers a firm to be green if it aims to limit its exposure to both physical and transitional environmental risks. My findings reveal that green firms are considerably less responsive to monetary policy surprises: In particular, following a 100 basis point surprise in monetary policy, stock prices of green firms fall by around 10% whereas the stock prices of their brown counterparts fall by around 21%.

To better understand the underlying drivers of the differential responses of green vs. brown firms to monetary policy shocks, I first look at differences in firm-level characteristics. At first glance, it is not obvious whether differences in characteristics should make green firms less responsive to monetary policy changes compared to brown firms. On the one hand, I document that greener firms are smaller and younger on average, pay lower dividends and are mostly classified as growth companies. On the other hand, I also show that greener firms tend to be on average less leveraged, more liquid and exhibit a larger distance to default compared to brown firms. I find that while some of these characteristics are important drivers of monetary policy heterogeneity on their own, they cannot explain the dampened sensitivity of green firms to monetary policy shocks.

Theoretical framework

I show that this dampened sensitivity is the result of investors’ preferences for sustainable investing. On the theoretical front, I consider a stylised framework where investors derive additional utility from their holdings of green assets. This model gives rise to 2 theoretical predictions. First, investors’ preferences for sustainable investing dampen the sensitivity of green asset prices to monetary policy shocks. Consequently, this dampened sensitivity is even more attenuated in states of the world with stronger preferences for sustainable investing. Second, contractionary monetary policy shocks lead to a reshuffling of investor portfolios toward green assets. This result stems from an imperfect substitutability between green and brown assets, leading “green” investors to hold onto their green portfolio positions amidst rising interest rates.

Empirical findings

On the empirical front, I find evidence in support of both model predictions. To proxy for investors’ preferences for sustainable investing, I leverage information from the CRSP survivorship-bias free mutual fund database and identify a set of sustainable index funds (i.e. funds with ESG mandates). In line with the first prediction, I show that green firms held by index funds with ESG mandates exhibit a lower sensitivity to monetary policy shocks compared to green firms held by non-mandated funds. Furthermore, I find that the heterogeneous response of green firms to monetary policy is more pronounced for green firms held by index funds that are located in: (i) regions with high exposure to natural disaster risk; (ii) US counties where climate change beliefs and risk perceptions are stronger; and (iii) times of heightened climate change concerns. In line with the second prediction, using security holdings data from large US institutional investors, I show that the share of green assets in the portfolios of institutional investors rises in response to contractionary monetary policy shocks.

Additionally, I go beyond the predictions of the stylised model and investigate whether investors make conscious portfolio rebalancing decisions in response to changes in the interest rate environment. In this vein, I investigate whether there are heterogeneities in the funding behaviour of mutual funds with and without ESG mandates. I find supporting evidence of an “active” portfolio rebalancing channel. Notably, following a 100 basis point surprise increase in the federal funds rate, outflows from institutional non-ESG-mandated mutual funds surpass those from ESG-mandated funds by approximately 7 percentage points. This points to a considerable reluctance of institutional investors to unwind their ESG portfolio positions in the face of adverse macro-financial shocks.

Policy implications

These findings have important policy implications. First, they inform the current policy debate on whether the recent monetary policy tightening may discourage green firms’ efforts to decarbonise. While green investments have relatively large upfront costs, which leave them highly susceptible to changes in the cost of credit, my results suggest that green firms also benefit from a relatively inelastic investor demand. Second, they shed a new light on the role of monetary policy during the Net-Zero transition: All else equal monetary policy may be less powerful in a world where the share of greener firms in the economy increases, or when preferences for sustainable investing intensify.

Related articles

AI and technology

Why AI’s role in the circular economy is deeply contested

Circularity may be popular with citizens, but when it comes to artificial intelligence, it becomes deeply divisive. Research co-authored by Shahzad Ansari of Cambridge Judge develops a framework to help find common ground based on purpose, strategy and governance regarding AI and circularity outcomes. The framework shows that debate about AI and circularity revolves around 3 questions: what AI is for, how circularity should be pursued and who gets to decide.

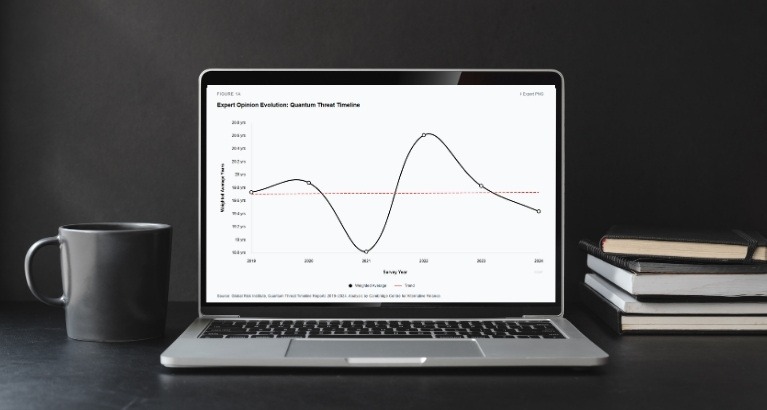

Industry leaders face a choice: act now or risk the integrity of blockchain-based markets and digital currencies, says Wenbin Wu, Research Associate at the Cambridge Centre for Alternative Finance (CCAF), Cambridge Judge Business School. Here we reveal regulators’ and policymakers’ bridging roles for quantum-resilient blockchains, and the importance of collaboration by technologists, economists, and regulators in the quantum age of financial technology.

AI and technology

How can AI in finance realise its full potential?

Kieran Garvey, AI Research Lead at the Cambridge Centre for Alternative Finance (CCAF), and Bryan Zhang, Co-Founder and Executive Director of CCAF, explore why banks struggle to turn AI efficiency into growth.