By Kevin Schneider, CERF/CCFin Research Associate, Cambridge Judge Business School, University of Cambridge

Seasonalities everywhere

Cambridge economists going back as far as John Maynard Keynes have long recognised that customer demand for numerous goods and services displays strong seasonal patterns over the year, with an ice-cream producer, for example, enjoying the largest demand for its goods in summer, but a toy-maker in the festive season in winter, while the harvesting season for lemon farmers begins as early as February (Keynes, 1936). These reoccurring and predictable cycles dominate firm behaviour and, likely, influence production, investment, and financing policies of firms. Indeed, there is a great literature in financial economics documenting all sorts of seasonal patterns in variables such as corporate earnings (Chang et al, 2017) and Hartzmark and Solomon, 2018), stock returns (Heston and Sadka, 2008, 2010) and Keloharju et al, 2016, 2021), and macroeconomic variables (Ogden, 2003). Recently, Grullon et al (2020) combine these seasonalities and find that firms earn low average stock returns in their high sales seasons and vice versa.

In this blog post, I summarise a novel angle on the literature using firms’ inventory policy as the key choice variable that ties seasonal patterns in firms’ accounting variables to seasonal patterns in their stock returns. The blog post is based on Aretz et al (2023) and I will be summarising both the theoretical and empirical contributions of the paper.

Modelling seasonality

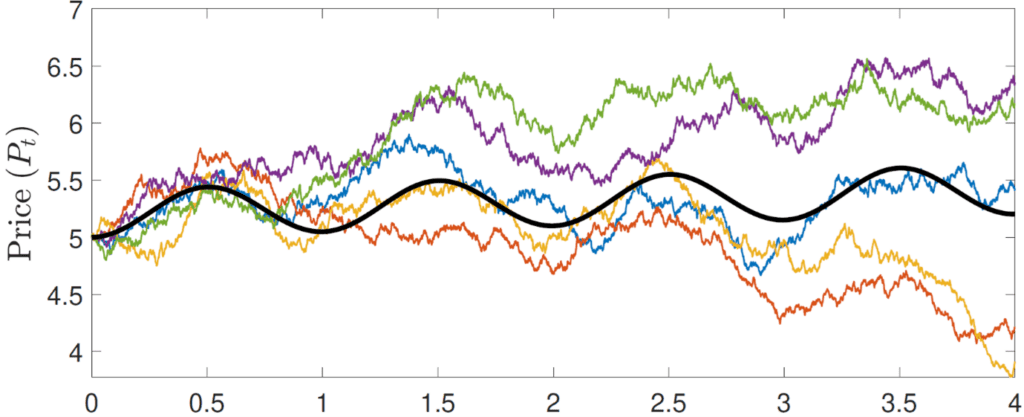

In Aretz et al (2023), we begin with a standard dynamic firm model in which firms choose their policies to maximise their equity value to which we make 2 contributions: first, we allow for seasonal patterns in firms’ exogenous product demand. For example, demand may always be high at the end of the calendar year due to Christmas. To model this behaviour, we add a sine function to the drift of the product demand, ensuring a periodic change from seasonal highs to seasonal lows.

Inventory building and seasonal operating leverage

A second novelty in Aretz et al (2023) is to allow firms to switch their finished output goods into an inventory to be sold later. Thus, firms in our model can make valuable selling choices. Given this setup, firms find it optimal to store their production output during seasonal lows in demand and to empty their entire inventory around seasonal highs. Importantly, separating production and sales leads to a timing mismatch between incurred production costs and earned sales revenue. As we show, this timing mismatch leads to a form of seasonal operating leverage where the sensitivity of net profits to sales changes over the seasonal cycle. Using standard finance theory, seasonal operating leverage carries through to firms’ market beta and systematic risk which also display seasonal patterns (see Carlson et al, 2004, Cooper, 2006, and Lambrecht et al, 2016). Intuitively, around seasonal lows in product demand, firms only begin building up their inventory and are thus burdened with a high present value of yet-to-be-paid production costs which translates into high operating leverage. As the firm approaches its seasonal highs, it pays the production costs while its sales revenue comes closer such that the firm operationally de-levers. Conversely, if we exclude the option to build up an inventory and force firms to sell their output instantaneously, output price seasonalities do not translate into return seasonalities. Taken together, firms’ optimal selling policies create endogenous seasonal operating leverage that is countercyclical: high (low) during seasonal lows (highs) in product demand.

Offering novel empirical evidence on the role of inventory building and the seasonal operating leverage pricing

In the following, I explain how we take the theoretical predictions above to the data and offer novel empirical evidence on the role of inventory building and the pricing of seasonal operating leverage.

Inventory is an important choice variable

Using granular data on orders, shipments, and inventory holdings of seven major industries from the Manufacturers’ Shipments, Inventories, and Orders (MSOI) database made available by the Census Bureau of the United States, we first confirm that new orders are re-occurring with an annual cycle and met with immediate shipments that are accompanied by a significant build-up in inventories. Turning to a broader set of all public firms in the US, we confirm that lagged inventory building is highly explanatory for future sales. The effect is particularly pronounced for industries producing durable consumer goods but less so for healthcare or service industries. We also show that firms’ financing behaviour aligns with the seasonal cycle and that firms deplete their cash holdings and increase their short-term debt over the costly inventory build-up period but increase their payouts to shareholders once the sales revenue has been earned around seasonal highs.

Seasonal operating leverage is priced in average stock returns

Realising that firm capitalise paid production costs of goods not yet sold as inventory on their balance sheet, we can directly measure the extent of seasonal operating leverage as abnormal inventory holdings, relative to their annual mean. Importantly, high abnormal inventory holdings indicate high already prepaid production costs (ie firms close to their seasonal highs that are operationally de-levered). As predicted by theory, sorting stocks into portfolios based on their abnormal inventory holdings yields a strong negative return spread that is not explained by leading factor models. Thus, operationally de-levered firms earn lower average returns than firms with high seasonal operating leverage. Fama-MacBeth regressions corroborate the results. We also show that market beta interacts with abnormal inventory holdings, suggesting seasonal variation in systematic risk.

Seasonal operating leverage and return anomalies

Finally, we draw comparisons between seasonal operating leverage and other famous return anomalies such as momentum and quarterly profitability (Jegadeesh and Titman, 1993) and Hou et al (2015). Both of these anomalies have a seasonal component and are weaker in an ‘inventory neutral’ setup when their spread portfolio does not include firms with high and low seasonal operating leverage.

Featured academic

Kevin Schneider

Research Associate in Theoretical Finance, Cambridge Centre for Finance (CCFin) and Cambridge Endowment for Research in Finance (CERF)

Featured research

Aretz, K., Liu, H. and Schneider, K. (2023) “Corporate real decisions, dynamic operating leverage, and seasonalities everywhere.” Working Paper

Article references

- Carlson, M., Fisher, A. and Giammarino, R. (2004) “Corporate investment and asset price dynamics: implications for the cross-section of returns.” Journal of Finance, 59: 2577-2603

- Chang, T.Y., Hartzmark, S.M., Solomon, D.H. and Soltes, E.F. (2017) “Being surprised by the unsurprising: earnings seasonality and stock returns.” Review of Financial Studies, 30: 281-323

- Cooper, I. (2006) “Asset pricing implications of nonconvex adjustment costs and irreversibility of investment.” Journal of Finance, 61: 139-170

- Dixit, A.K. and Pindyck, R.S. (1994) Investment under uncertainty. Princeton, NJ: Princeton University Press

- Grullon, G., Kaba, Y. and Núñez, A. (2020) “When low beats high: riding the sales seasonality premium.” Journal of Financial Economics, 138: 572-591

- Hartzmark, S.M. and Solomon, D.H. (2018) “Recurring firm events and predictable returns: the within-firm time series.” Annual Review of Financial Economics, 10: 499-517

- Heston, S.L. and Sadka, R. (2008) “Seasonality in the cross-section of stock returns.” Journal of Financial Economics, 87: 418-445

- Heston, S.L. and Sadka, R. (2010) “Seasonality in the cross section of stock returns: the international evidence.” Journal of Financial and Quantitative Analysis, 45: 1133-1160

- Hirshleifer, D., Jiang, D. and DiGiovanni, Y.M. (2020) “Mood beta and seasonalities in stock returns.” Journal of Financial Economics, 137: 272-295

- Hou, K., Xue, C. and Zhang, L. (2015) “Digesting anomalies: an investment approach.” Review of Financial Studies, 28: 650-705

- Jegadeesh, N. and Titman, S. (1993) “Returns to buying winners and selling losers: implications for stock market efficiency.” Journal of Finance, 48: 65-91

- Keloharju, M., Linnainmaa, J.T. and Nyberg, P.M. (2016) “Return seasonalities.” Journal of Finance, 71: 1557-1590

- Keloharju, M., Linnainmaa, J.T. and Nyberg, P.M. (2021) “Are return seasonalities due to risk or mispricing? Evidence from seasonal reversals.” Journal of Financial Economics, 139: 138-161

- Keynes, J.M. (1936) The general theory of employment, interest, and money. London: Palgrave Macmillan.

- Lambrecht, B.M., Pawlina, G. and Teixeira, J.C.A. (2016) “Making, buying, and concurrent sourcing: implications for operating leverage and stock beta.” Review of Finance, 20: 1013-1043

- Ogden, J.P. (2003) “The calendar structure of risk and expected returns on stocks and bonds.” Journal of Financial Economics, 70: 29-67