New digital tool launches to navigate the DeFi ecosystem

The Cambridge Centre for Alternative Finance (CCAF), a part of Cambridge Judge Business School at the University of Cambridge, has launched a new open-access digital tool, the Cambridge DeFi Navigator. The dashboard provides policymakers, financial authorities, industry professionals and the general public with a trusted and comprehensive source of decentralised finance (DeFi) data and educational content. With real-time datasets and interactive visualisations, it provides greater transparency and insights into the DeFi landscape.

The DeFi ecosystem has experienced extraordinary growth, with TVL surging from a few billion USD in its early stages to over $100 billion today. This expansion presents unprecedented opportunities for historically unbanked individuals. However, it also exposes participants to several risks, including security vulnerabilities, governance challenges, and the complexities of an evolving regulatory environment. At a time when Bitcoin has reached an all-time high and DeFi’s influence continues to grow, the release of the Cambridge DeFi Navigator aims to shed light on both adoption trends and the risks involved with participating in this ecosystem. This tool equips industry participants, policymakers, and researchers with essential insights into the dynamics and risks of the ecosystem, enabling them to navigate the innovative DeFi ecosystem with greater transparency and confidence.

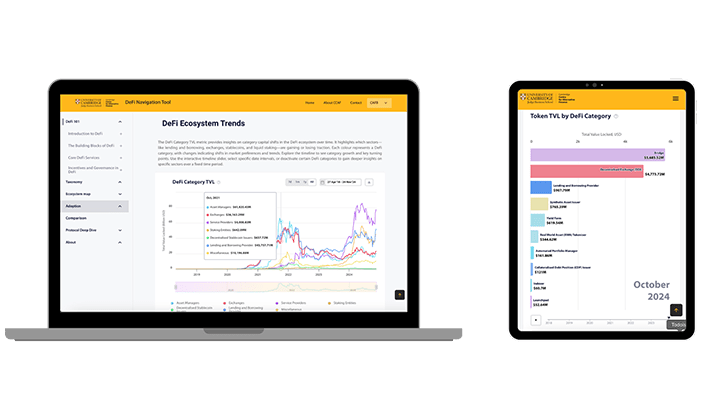

To offer a comprehensive understanding of the DeFi ecosystem, the digital assets team at the CCAF has developed a DeFi taxonomy that aims to bridge the understanding between traditional and decentralised finance. To visually portray the ecosystem, the Cambridge DeFi Navigator maps the protocols according to the developed taxonomy and provides insights into the value flows from one DeFi sector to another. Additionally, the tool offers insights into the adoption of various protocols and DeFi sectors over time, by identifying variations in capital flows within the ecosystem. Lastly, the tool highlights several critical risks within DeFi such as governance token distribution, custody, security, and other economic indicators, enabling a detailed and analytical evaluation of the risks involved with specific protocols.

Overview of the Cambridge DeFi Navigator

The first phase of the tool includes 6 sections: DeFi 101, DeFi Taxonomy, Ecosystem Mapping, Adoption, Comparison, and Protocol Deep Dive.

1

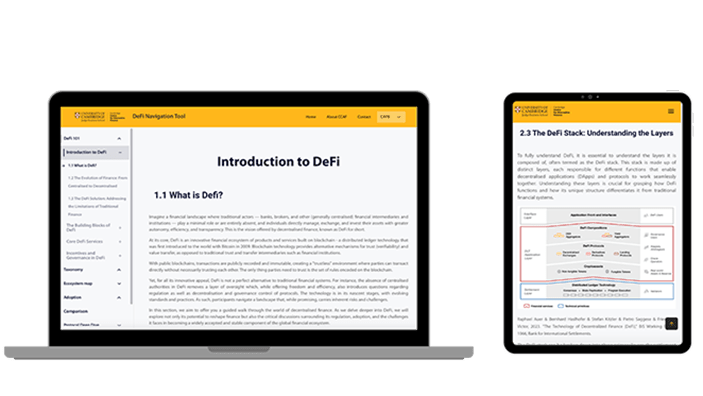

DeFi 101

To tackle the steep learning curve in DeFi, this section offers the general public an interactive guide to bridge knowledge gaps, presenting a clear, expertly-synthesised overview of the evolution of finance and the emergence of DeFi. Its comprehensive sections on the building blocks of Defi and the core DeFi services help simplify the complex landscape, making DeFi knowledge accessible to beginners and experts alike.

2

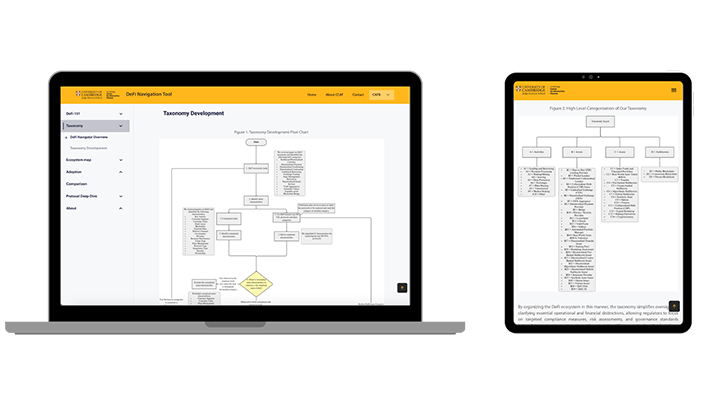

DeFi taxonomy

To bridge the gap in understanding between traditional finance and decentralised finance the digital assets team at the CCAF has developed a DeFi taxonomy by conducting a comprehensive literature review, identifying the most important meta-characteristics and analysing the top 200 protocols by TVL on Ethereum. The taxonomy is aimed to offer a framework for organising protocols by key activities and governance structures, while providing both regulators and industry participants a collective methodology for viewing various protocols.

3

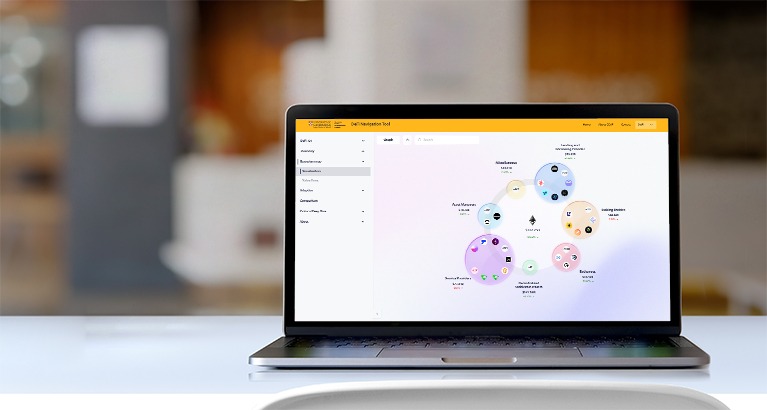

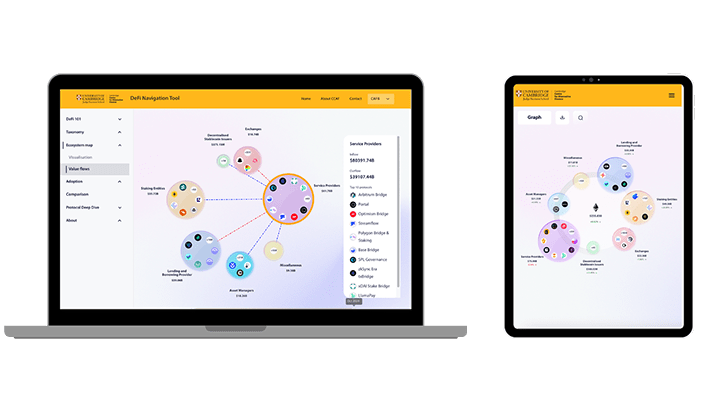

Ecosystem mapping

To gain a comprehensive understanding of DeFi’s interconnected structure and better understand the interplay between various DeFi sectors, the ecosystem and value flow maps provide industry participants, regulators, and researchers with an interactive way of seeing the entire DeFi ecosystem as well as its accompanying value flows at a glance. Both maps organise protocols into various DeFi categories in accordance with the proposed taxonomy. To better understand the dynamics between various Defi categories the Value Flows Map visualises the inflows and outflows of DeFi categories, providing a quantitative view of the value of interactions between different protocols within the ecosystem.

4

Adoption

Recognising the difficulty in tracking and understanding DeFi adoption trends, this section provides industry professionals and regulators with near real-time data as well as user-friendly data visualisations and analytics to help understand which DeFi categories and protocols are most dominant at different points in time. This section offers dynamic, data-driven insights into the DeFi ecosystem, including TVL trends, protocol dominance, and token adoption by leveraging various metrics based on TVL.

5

Comparison

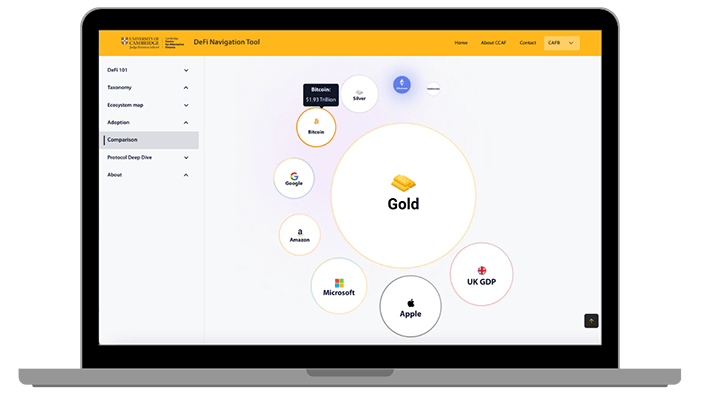

Understanding DeFi’s relative market size can help regulators and industry participants gain insights into shifting global investment dynamics, and DeFi’s relative size in comparison to other well-known financial instruments. The Comparison section of the tool highlights DeFi’s economic significance by benchmarking its market size against Ethereum and comparing it to assets like Bitcoin, gold, silver, major tech companies, and national economies like the UK.

6

Protocol Deep Dive

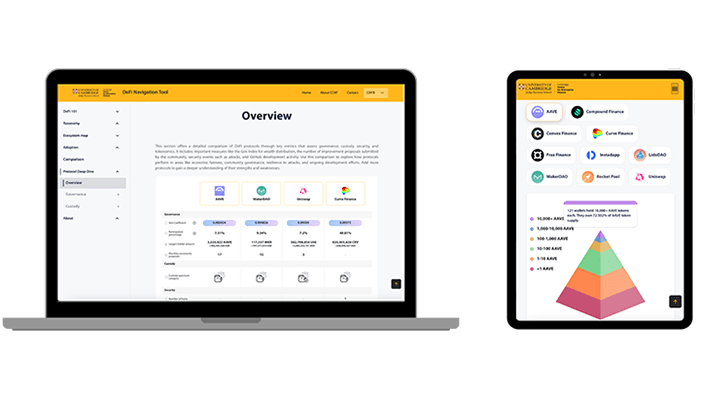

Highlighting the inherent risks, the Protocol Deep Dive section equips users with critical insights into the governance, custody, and security of DeFi protocols. By leveraging metrics such as the Gini Coefficient of governance tokens, participation rate in governance proposals, and data on custody models, this tool empowers industry participants and regulators to assess the decentralisation, fairness, and resilience of protocols. Users can identify imbalances in governance token distribution or detect vulnerabilities in custody arrangements, enabling more informed decisions on engagement and oversight. This detailed evaluation fosters transparency, offering a clear view of the strengths and weaknesses of protocols, and helping stakeholders mitigate risks while navigating the complex DeFi landscape.

Reflections on the initial launch of the dashboard

The Cambridge DeFi Navigator addresses the need for a comprehensive and trusted resource to monitor both the adoption and inherent risks of the DeFi ecosystem. The tool combined with our proposed DeFi taxonomy, aims to demystify the world of decentralised finance and provide users with the insights necessary to bridge understanding gaps between traditional finance and decentralised finance. As the tool is extended to include more granular data on specific protocols, we expect users to be able to gain a detailed overview of the Defi landscape at a glance.

More empirical data and insights on the development of DeFi ecosystem underpinned by a working taxonomy will shed light on this complex and evolving sector, to unlock sustainable growth potential but also mitigate existing and emergent risks

The empirical data for the dashboard is sourced from various leading providers, including Alterscope, DeFiLlama and Flipside.

DeFi is evolving rapidly, yet it remains fraught with complexities, including hidden risks related to security, governance, and liquidity dependencies. The Cambridge DeFi Navigator is a transformative tool, offering unparalleled transparency by mapping protocol dependencies, visualizing value flows, and highlighting adoption trends over time. This empowers policymakers, financial authorities, industry professionals, and the public to better understand and navigate the DeFi landscape. At Alterscope, we are proud to contribute to this open-access initiative, supporting the Cambridge DeFi Navigator in advancing clarity and fostering informed engagement in the dynamic world of DeFi.

Getting clean, usable blockchain data into the hands of builders is critical for DeFi to reach its potential. At Flipside, we've found that transforming messy on-chain data into clear insights helps everyone – from major institutions to scrappy protocols – helps everyone build better and smarter. The Cambridge DeFi Navigator is a big step forward in bringing transparency and understanding to an ecosystem that needs more of it as adoption increases

The Cambridge Digital Money Dashboard is a research output of the Cambridge Digital Assets Programme, a multi-year research initiative hosted by the CCAF in collaboration with 18 prominent public and private institutions. The Programme provides the datasets, digital tools and insights necessary to facilitate a balanced public dialogue about the opportunities and risks a growing digital asset ecosystem presents. The ultimate objective is to help inform evidence-based decision-making and regulation through open-access research.

CDAP’s founding institutional collaborators are (in alphabetical order) Bank for International Settlements (BIS) Innovation Hub, British International Investment (BII), Dubai International Finance Centre (DIFC), EY, Fidelity Investments, UK Foreign, Commonwealth & Development Office (FCDO), Goldman Sachs, Inter-American Development Bank (IDB), International Monetary Fund (IMF), Invesco, Mastercard, MSCI, Visa and World Bank. Four new members have recently joined the effort: NatWest, Switzerland’s State Secretariat for Economic Affairs (SECO), Euroclear and the Depository Trust & Clearing Corporation (DTCC). The CDAP distributed Financial Market Infrastructure research stream is advised and co-chaired by Rasheed Rasheed Saleuddin.

DeFi promises so much, but its complexity can be hard to navigate for many. Our DeFi Navigator is an important step in increasing understanding and insight, and we hope will be a significant step forward in the developing maturity of the DeFi ecosystem.

The newly developed Cambridge DeFi Navigator does a great job of disentangling the growing DeFi ecosystem by providing a clear classification and an appealing visual overview. Information on Total Value Locked within different protocols help to understand both the absolute as well as the relative size of different applications. GINI Coefficients very close to 1 even for the most known applications indicate that there is still a way to go to reach true decentralisation.

Cambridge DeFi Navigator

This innovative tool, provided by the Cambridge Centre for Alternative Finance, offers real-time data and interactive visuals to help users confidently navigate the DeFi landscape.