The Centre for Risk Studies was established to advance the areas of science that inform the decisions made by government policy-makers, company risk managers, and other institutions and individuals that are faced with risks of low probability and high consequence. Today there is a growing commercial industry of catastrophe risk analytics in insurance and the capital markets, a well-established profession of private sector financial risk managers and a developing strand of business operational management headed by the Chief Risk Officer that is increasingly concerned with understanding, measuring, and dealing with a wide range of types of corporate risk.

In the public sector, risk management is an increasingly important component of government and policy. Risk-based government and evidence-based policy-making are gaining credence as political approaches, and formal risk analysis approaches are finding their ways into public safety policy, civil protection and emergency preparedness planning.

Risk science is fundamental to these applications: applications that draw heavily on mathematical theory, social and behavioural studies, understanding of the perils and processes that drive individual threats, and management studies of implementing risk reduction strategies.

The Centre for Risk Studies serves these audiences, providing fundamental research as a basis for developing the discipline long term, exploring new areas and creative breakthroughs, an academic framework for risk management decision strategies, and creating a career path for researchers emerging from the University.

A focus on complex risk

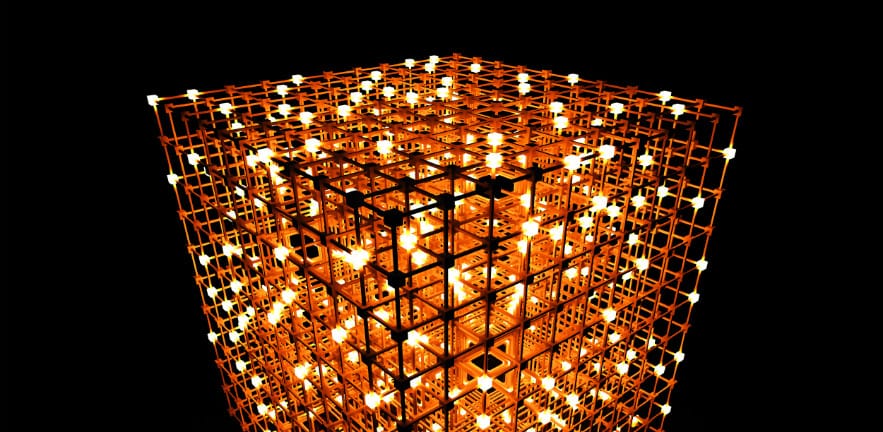

The Centre for Risk Studies originated from an overlap of specialised research interests into both complex systems and catastrophe risk analysis. Being located in Cambridge Judge Business School has enabled the Centre to apply these interests to the business community and to structure an appropriate multidisciplinary team.

The research of the Centre maintains a focus on ‘complex risk’ ie processes where loss occurs through the disruption of business systems and cascades through interrelated networks in complex and non-intuitive ways. The management and governance of complex risk has attracted interest and support from several sectors of the business community and government policy makers, including the financial services industry, the energy sector, and major corporations. It poses a wide range of analytical and methodological challenges for the academic community to tackle. These different stakeholders form the community served by the Centre for Risk Studies.

Demonstrating impact

The Centre is proactive in disseminating its research outputs and demonstrating that such outputs have business value to a community of subscribers. The Centre’s programme of dissemination and community building gives the team confidence that the research is relevant and has real impact.

Full research programme

The Centre is pursuing a full research programme, expanding the active research team and working in a number of challenging areas. Achievements include:

- methodology breakthroughs

- conceptual innovation

- development of new tools and approaches that have attracted positive peer review and external attention.

Executive education in risk management

The Centre is expanding its engagement activities with the business community. It is doing this by developing an executive education offering through a partnership with Cambridge Judge Business School Executive Education. The executive-level programme in risk management should broaden the corporate engagement profile at the Centre. It will also promote research activities through its ‘deep engagement’ opportunities.

Academic output

The Centre contributes to the educational priorities of CJBS and engagement with the students through its MBA elective in Risk Management and the award of the McKinsey Risk Prize. For our more theoretical and fundamental research, we expect the planned academic programme to require sustainable and longer-term funding from a funding body such as the Research Councils.