The Bank of England has published its latest Inflation Report alongside forecasts for economic growth and a decision to hold interest rates. The background to those announcements has echoes of almost 50 years ago, when sterling was devalued by 14% against the US dollar. The then prime minister, Harold Wilson, stated: “It does not mean that the pound here in Britain, in your pocket or purse or in your bank, has been devalued.” This, of course, was nonsense: except for any consumers that were not buying any goods or services produced abroad.

The 1967 devaluation caused political turmoil. Right now, since the referendum on the European Union, the pound in our pockets has, in effect, been devalued. Sterling has fallen by more than 18% against the US dollar. As with 1967, the current fall in the exchange rate is adding to uncertainty and the under-fire Bank of England takes much of the responsibility to sort out the economy. Some of that responsibility should soon pass to policy makers at HM Treasury.

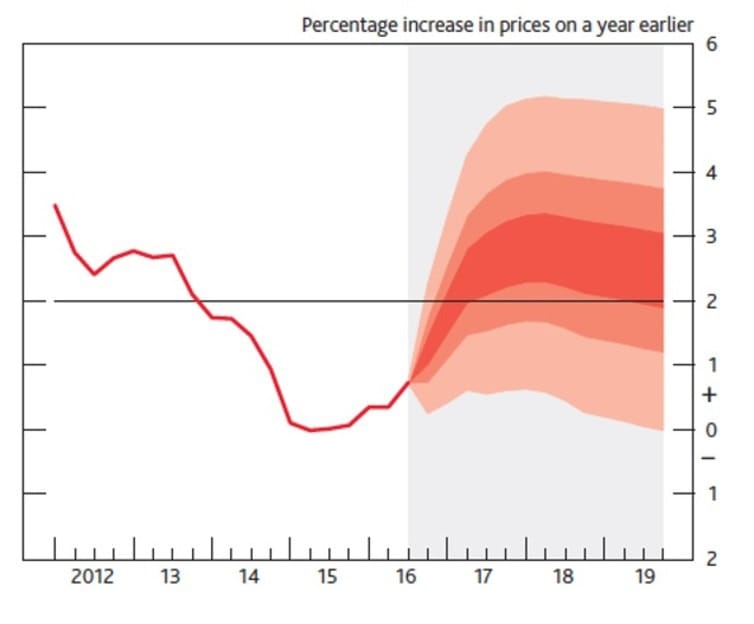

The Bank has an annual consumer price inflation target (set by the government) of two per cent, and current inflation is below this at around 1%. But the latest report shows that the Bank believes that inflation is now increasing and will be above its central target of 2% in the near future. Much of this can be explained by the recent fall in sterling.

The chart below shows what the Bank expects inflation will be in the future. As there are uncertainties surrounding such projections the chart is shown as a “fan diagram” where the darker colour is considered the most likely outcome. In its central projection, the Bank predicts inflation will be around 2.7% in 2017 and 2018.

Impact assessment

A fall in the exchange rate has a mixed impact on the economy. First, it increases inflation and devalues the pound in our pockets. Second, it reduces the foreign price of our goods and services which should stimulate exports.

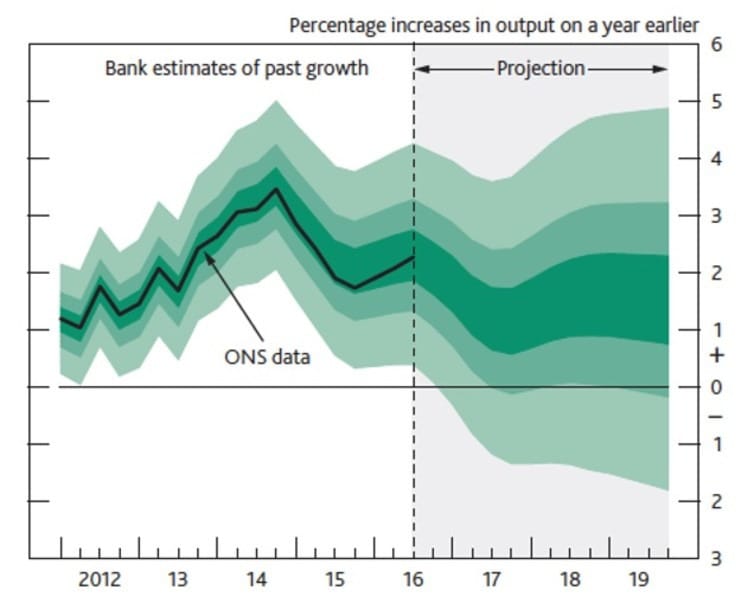

A growth in exports will boost GDP but, despite this, the Bank’s estimates (as shown in the chart below) suggest that future economic growth is going to be very sluggish. The Bank’s central forecast suggests that growth will be 1.4% in 2017, 1.5% in 2018 and 1.6% in 2019. These growth rates are much lower than would be expected in ‘normal times’ and indicate that the legacy of the financial crisis combined with the prospect of Brexit are constraining growth.

This creates a policy dilemma for the Bank: it can try to stick to its inflation target, but this will lead to slower growth of the economy. The Bank’s decision to leave monetary policy unchanged indicates that it is taking the alternative course for the time being: letting inflation overshoot its target to help maintain economic growth.

The limits of monetary policy

The Bank is running out of options to stimulate the economy. Interest rates are near to zero and the impact of quantitative easing is uncertain. But criticism of the Bank and its governor is not helpful as the Bank has been doing what it can but is now running out of ammunition to generate growth. It is time for government to use the tools at its disposal. When the chancellor of the exchequer, Philip Hammond, delivers his Autumn Statement on 23 November, it will be an opportunity for the government to engage in a fiscal stimulus – particularly to boost spending on infrastructure.

There is also the vital need for a coherent and transparent industrial policy to support the production of tradable goods and services and to ensure that the prospect of Brexit does not lead to a major fall in foreign direct investment.

Here the portents are not good: the deal with Nissan smacks of a secret deal for a powerful multinational. This is not evidence of a transition to a world of free trade and open competition but the desperate support for vested interests.

Project reality

The evidence from the Bank and others, such as the National Institute of Economic and Social Research, suggests that the economy is moving into a period of higher inflation and slow growth. This will affect the pound in our pockets – we will have fewer of them than we expected and those that we do have will not buy so much.

It is unlikely that Brexit will lead to a major recession – but the early signs are that it will lead to a persistently slow-growing economy. This is not part of so-called Project Fear but the reality based on the emerging facts and not on a plague of factoids.

This article was originally published in The Conversation.