by Shiqi Chen, Research Associate, Cambridge Centre for Finance and Cambridge Endowment for Research in Finance

Debt-equity conflict is undoubtfully one of the core paradigms of corporate finance research. It is well-known that, once debt is in place, the misalignment of interest between debt holders and equity holders can lead to asset substitution and inefficient underinvestment problems, which are initially identified by Jensen and Meckling (1976) and Myers (1977), respectively. More recently, studies by Admati et al. (2018) and DeMarzo and He (2020) highlight another consequence of debt-equity conflicts: the leverage ratchet effect, that is, when firms cannot commit to future debt levels, once debt is in place, equity holders not only are reluctant to reduce leverage voluntarily, but also have an incentive to increases the firm’s leverage to the detriment of debt holders. They show that such debt-equity conflicts due to non-commitment give rise to leverage dynamics that differ substantially from what is implied by the static trade-off model, and may help to explain many empirical phenomena that otherwise remain puzzling – for example, the reluctance of distressed firms to recapitalise.

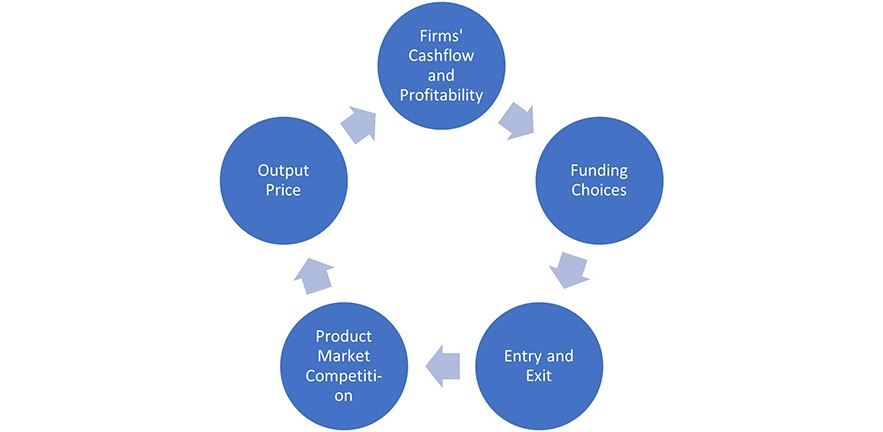

However, it is important to note that an individual firm is not a solo player in the market. Firms’ entry, exit, production and financing decisions need to be considered in a broader context. Indeed, firms’ capital structure dynamics and product market decisions are closely intertwined. If debt-equity conflicts persist among firms, the corresponding influence can aggregate rapidly at the industry level and have a profound impact on product market competition, output prices and other dimensions of industry dynamics. In turn, the degree of product market competition and equilibrium output prices are key determinants of industry players’ profitability and survivorship. Therefore, product market behaviour affects the evolution of debt-equity conflicts and funding choices at the firm level. Such interaction (shown in the figure below) is highlighted in Zingales (1998), “in the absence of a structural model, we cannot determine whether it is the product market competition that affects capital structure choices or a firm’s capital structure that affects its competitive position and its survival”.

What has happened in the oil industry in 2020 mirrors such interactions. In 2020, the price war between Russia and Saudi Arabia, coupled with prolonged pandemic and subsequent collapse in global demand had tumbled many heavily indebted oil and gas producers. The West Taxes Intermediate was even trading in the negative territory for the first time in April. Since 2008, the surges in crude export have led to a shale boom in North America, as well as an all-time high aggregate debt level in the oil and gas sector. According to the report by Haynes and Boone, 46 North American oil and gas producers have filed Chapter 11 bankruptcy in 2020, among which 14 are billion-dollar bankruptcies. The imminent consolidation and reshuffle within the industry are going to create further fluctuations in oil prices and variations in the survivors’ capital structure. These emphasise the intriguing interdependencies between firms’ financial decisions, market competition and industry dynamics.

In the article “Industry Dynamics and Capital Structure (Non)Commitment”, CERF Research Associate Shiqi Chen and collaborator Hui Xu (University of Lancaster) attempt to address these interactions. It develops a competitive equilibrium model to understand how the debt-equity conflicts arising from the absence of equity holders’ commitment to future debt levels affect industry dynamics and the corresponding feedback effect on firms’ financial decisions. The article shows that shareholders’ resistance to leverage reduction and incentives to increase leverage make debt financing more expensive. As a result, entry into the industry becomes harder, which reduces the degree of market competition and raises the equilibrium output price. The increase in the output price, in turn, improves the profitability of industry incumbents and makes the shareholders willing to wait longer before shutting down firms, thereby alleviating inefficient liquidation and the agency costs generated by non-commitment. By looking at the stationary industry distribution of firm in terms of debt-scaled cashflow, they find that, compared with the commitment case, non-commitment and the resultant higher output price increase the number of firms in the high leverage region and the overall average industry leverage. More firms now stand close to the exit boundary. Such distributional effect gives rise to a higher frequency of entry and exit, and consequently, a higher market turnover rate at the equilibrium. The results suggest that debt-equity conflicts at the firm level can ramp up and have profound implications on industry dynamics.

References

Admati, A.R., DeMarzo, P.M., Hellwig, M.F. and Pfleiderer, P. (2018) “The leverage ratchet effect.” Journal of Finance, 73(1): 145-198

DeMarzo, P. and He, Z. (2020) “Leverage dynamics without commitment.” Journal of Finance, 76(3): 1195-1250

Jensen, M.C. and Meckling, W.H. (1976) “Theory of the firm: managerial behavior, agency costs and ownership structure.” Journal of Financial Economics, 3(4): 305-360

Haynes and Boone (2020) “Haynes & Boone: Oil Patch Bankruptcy Monitor (31 December 2020)” (Accessed 21 January 2022)

Myers, S.C. (1977) “Determinants of corporate borrowing.” Journal of Financial Economics, 5(2): 147-175

Zingales, L. (1998) “Survival of the fittest or the fattest? Exit and financing in the trucking industry.” Journal of Finance, 53(3): 905-938