For Carl Bradshaw, partner at Kirkland & Ellis International, the financial crisis was an opportunity, not a disaster. He explains how he carved a career in a time of rapid change.

The shock that went through the financial system in 2008 caused a lot of career casualties. But for Carl Bradshaw (MPhil 2005), fresh out of business school and eager to make his mark, it was the perfect opportunity to prove his worth right at the beginning of his career.

“Lehman Brothers collapsed within two weeks of me starting my graduate training in the building next door,” he remembers. “While I certainly saw lots of turmoil and uncertainty, it was a huge advantage to find myself learning my trade at a time when quality and efficiency were paramount in providing legal services.”

A keen rugby player, his first degree in sports science and management at Loughborough University was all about playing to his strengths as he climbed the ranks of professional club Northampton Saints. But he came to decide that his future lay in the boardroom rather than on the sports field and managed to secure a place at Cambridge to read a Diploma in Management Studies at CJBS followed by an MPhil in Innovation, Strategy and Organisation.

“If you’d told me at 16 that I would be studying for another seven years, I wouldn’t have believed you,” he says. “But I enjoyed the academic side and wanted to prepare myself for life afterwards by gaining a set of qualifications that would give me options in the jobs market.”

He still fondly remembers Dr Mark de Rond’s negotiation workshops on his Management Studies course. “They were a very practical introduction to game theory, and something I have been able to put into practice on an almost daily basis – although the faces across the table these days are not always as reasonable as my CJBS adversaries.”

Qualifications in law followed, and he had just begun his training contract with Clifford Chance in London and Hong Kong when the crisis hit. He made the most of the opportunities that came his way. “I was able to build my career as the financial markets slowly recovered and maybe I had a little more eagerness than many of those who had been around in the good times and who now bemoaned working harder, for longer, for less.”

Private equity appealed, he says, to “the businessman in me” and, on qualifying as a solicitor in 2010, he moved to Kirkland & Ellis, a 1,600-attorney Chicago-headquartered firm which acts for more private equity sponsors than any other law firm in the world. He became a partner in the firm’s City office in 2015, and having advised high profile clients such as Apollo, Bain Capital and TowerBrook on a series of complex cross-border deals, he recently won recognition in the Super Lawyers’ London Rising Stars List for mergers and acquisitions, corporate finance and business affairs.

Alongside his corporate career, Bradshaw has also contributed significant pro bono work. His latest project has been giving contract advice to World Vision, a charity which works with children in the developing world, which had won a grant from the UK government for a community rebuilding programme in Ebola-affected areas. Bradshaw says “pro bono work is a rewarding way to develop and leverage my legal and commercial skills for causes that really matter and it’s something I feel ethically compelled to stay hands-on with as my career progresses.”

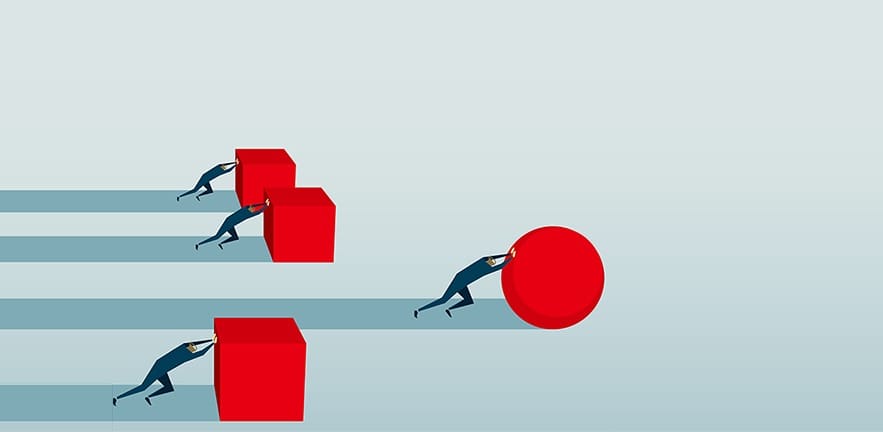

And Bradshaw is also looking forward to the challenges brought by his new role as a partner. There’s increased opportunity, he says, but there’s also plenty of competition out there – as well as having to deal with the vagaries of the market.

“What private equity looks like now is a different field to what it was ten years ago,” he says. “There are more and more players looking to invest capital. The strategies for doing that are changing, as are the sources of finance and the kinds of businesses that are attractive to private equity investors. For me, it’s all about staying on top of that and trying to see round the corner. That way, you can become a trusted adviser to your clients, helping them find solutions to the challenges they’re facing.” And given his experience in the formative years of his career, Bradshaw is sure to thrive as the industry changes continue.

Carl is interested in meeting…

…any former classmates or graduates of CJBS who are working in the private equity space and people in the legal industry generally.