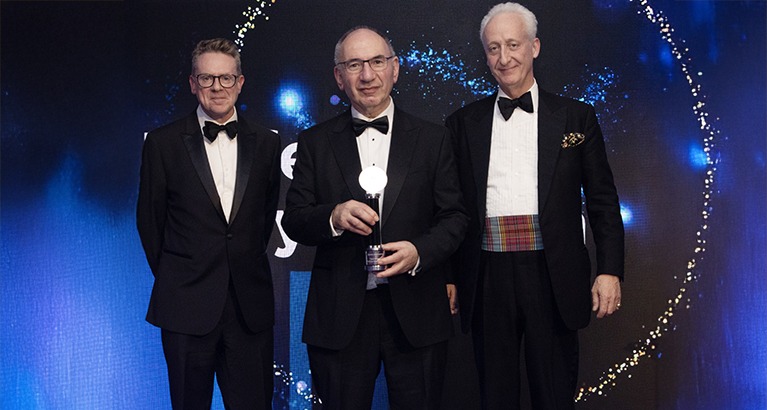

The Lifetime Achievement Award from PAM Insights cites his work in research, teaching and for producing with academic colleagues an essential asset-returns database.

Stock market returns have been lower in the first quarter of the 21st century than the 20th century, but still had annualised real returns of 3.5%, says report co-authored by Professor Elroy Dimson.

Annual UBS Investment Returns Yearbook, co-authored by Professor Elroy Dimson of Cambridge Judge Business School, finds that Japan, Canada, Germany, Australia and other nations have lost stock market share to the US.

Finance and accounting

History shows inflation is stubborn when it hits 8%

Inflation hit decades-long highs in 2022, and easing is historically very slow from such levels, says new report co-authored by Elroy Dimson of Cambridge Judge Business School.

Top awards granted at the European Investment Forum organised by the Centre for Endowment Asset Management at Cambridge Judge Business School and FTSE Russell, a London Stock Exchange Group (LSEG) company. A paper on environmental activist investing and a presentation on the value of privacy for individuals won top awards at the European Investment Forum in Cambridge, which was organised by the Centre for Endowment Asset Management (CEAM) at Cambridge Judge Business School and FTSE Russell, an LSEG business. The 12-14 September Forum showcased innovative ideas across the natural and social sciences, and explored such ideas as quantum computing, digital currency opportunities and challenges, and sustainable investing. An integral part of the Forum is a research competition for early career academics, with 97 entrants competing for an opportunity to present at the event. Two winners were selected from the finalists and awarded for best paper prize and best presentation. The Best Paper award was won by Lakshmi Naaraayanan, Assistant Professor of Finance at London Business School, for a study entitled "The Real Effects of Environmental Activist Investing". "Using plant-level data, we find that targeted firms reduce their toxic releases, greenhouse gas emissions, and cancer-causing pollution," says the study. "Improvements in air…

Insight

American exceptionalism

The outperformance of US equity markets in the last century has continued in the 21st century, says a new study co-authored by Elroy Dimson of Cambridge Judge Business School.

Research paper co-authored at Cambridge Judge Business School on how investors can influence companies on environmental and social issues is named best paper in the annual Brandes Institute Prize.

Insight

Not as rosy

Study of four Cambridge and Oxford Colleges co-authored at Cambridge Judge Business School shows that long-term property investment is less profitable than previously thought.

Misc news

Long-term returns

Following high returns in the 1980s and 1990s, real equity returns have since been below historical averages despite pandemic recovery, says Credit Suisse Yearbook co-authored by Professor Elroy Dimson from Cambridge Judge Business School.

Misc news

Ratings divergence

Paper co-authored by Professor Elroy Dimson of Cambridge Judge Business School on environmental, social and governance investment ratings wins Best Article award from the Journal of Portfolio Management.

Insight

Over the horizon

University endowments use their long-term perspective to invest countercyclically at times of stock-market crisis, says new study at the Centre for Endowment Asset Management at Cambridge Judge Business School.

The next generation will face real investment returns of only two per cent based on historical data, says Professor Elroy Dimson. The "Generation Z" born between the mid-1990s and early 2010s will likely face a future of very low annualised real investment returns of about two per cent, Professor Elroy Dimson of Cambridge Judge Business School told a webinar organised by the CFA Institute. The presentation by Elroy, Chairman of the Centre for Endowment Asset Management at Cambridge Judge, is based on historical data in his co-authored comprehensive global review of investment returns in 23 different countries, which now covers 120 years from 1900 through 2019. He updates the study annually with his co-authors Professor Paul Marsh and Dr Mike Staunton of London Business School. "We are in a world where, looking forward, you can expect a typical investment portfolio to beat inflation by only two per cent," Elroy told the CFA Institute webinar, which attracted an online audience of global investment professionals. The Baby Boom generation born just after World War II enjoyed "remarkably" good annualised real (after inflation) returns of seven per cent for equities and 3.5 per cent for government bonds; the following Generation X has seen…