Business practices that promote sustainability can be a win-win-win: for the planet, for companies, and for individuals. So how can organisations make sure they’re acting responsibly in every aspect of their operations?

Responsible investment

Most people, most governments, and indeed most investors would like to see companies act more transparently and responsibly in implementing business models that are compatible with climate sustainability. Yet, so few companies have moved to act in this way.

Pembroke Visiting Professor of Finance David Pitt-Watson highlights one reason, saying that, until recently, companies were able to declare profits as if climate change simply did not exist by valuing assets and calculating profits as though there was no climate threat.

For example, companies have assumed that the future of a thermal power plant or a fossil fuel engine factory was only limited by its technical life, unchallenged by climate concerns. This meant that annual depreciation was lower, and profits consequently higher.

In most cases companies didn’t even tell their investors what climate assumptions underpinned the company’s profits – and the bonuses they paid their executives. Pitt-Watson, along with colleagues in the Accounting and Finance departments, is aiming to put a stop to this short-sighted approach to calculating profits.

There’s still a long way to go, but such changes have seen oil and gas-giant BP write off $16 billion in assets and cut back its exploration expenditure, citing climate concerns.

Speaking in conversation with Professor Jennifer Howard-Grenville during the first annual Trinity Hall Social Entrepreneurship Lecture, venture capital pioneer and philanthropist Sir Ronald Cohen said that regulators are likely to require companies to publish audited reports on their environmental and social impacts.

Sir Ronald, Chair of the Global Steering Group for Impact Investment and The Portland Trust, thinks that regulators will step in within the next three to five years. He says that regulators will mandate that companies must publish audited impact-rated accounts that take into consider the environmental and the social impact that companies create, both positive and negative.

It’s not just companies that can lead the way by acting more responsibly. Investment practitioners can also engage on environmental, social and governance (ESG) topics with shareholders and governments.

An award-winning study from the Centre for Endowment Asset Management (CEAM), co-authored by Professor Elroy Dimson, Dr Oğuzhan Karakas and Dr Xi Li, has explored how investors can influence companies on environmental and social issues.

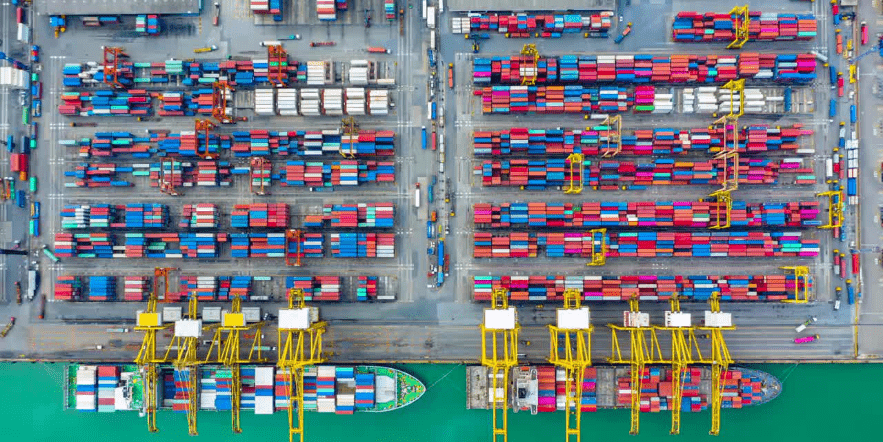

Making supply chains sustainable

Companies can also ensure that they are acting responsibly by aiming to make their supply chains more sustainable.

Working across industries, and interviewing companies ranging from large breweries to major automakers, a guide for procurement professionals says companies should engage with supply chain sustainability by leveraging a ‘spectrum’ of approaches.

Produced by Professor Jennifer Howard-Grenville and Dr Julia Grimm, the guide rejects a ‘one best approach’, instead calling for a combination of practices suited to specific circumstances and issues a given company might be facing.

The interview with the brewing company, one of 75 conducted with sustainability and procurement leaders around the world, illuminated a hybrid approach to working with a firm’s different supply chains – involving engagement with suppliers and a broader ecosystem in a coordinated and collaborative manner simultaneously.

The interview with the automaker revealed that they had worked collaboratively with the automotive ecosystem to integrate sustainability standards into a supplier code of conduct. One supplier’s product, following the automaker’s investment and support, was then scaled up to become an industry-wide standard.

Supply chain collaboration will help build long-term relationships with suppliers and unearth untapped sustainable targets. However, if circular supply chains are to be achieved there may need to be some collaboration and compromise from consumers as well as companies.

Existing supply chains are built on principles of centralisation (to achieve volume and economies of scale) and specialised parts that maximise short-term product cost and functionality, making a circular model prohibitively expensive.

An article written by Professor Christoph Loch and Dr Khaled Soufani in Harvard Business Review, says that adopting circular business models is in many cases hard to achieve in the immediate future, unless consumers are willing to compromise a bit on performance and cost in order to get sustainability.

Measuring the impact of environmentally-conscious activities

Companies may seek more sustainable investment practices and implement more environmentally-friendly supply chains, but how will they know the impact of their actions?

Writing for Harvard Business Review, Professor Jennifer Howard-Grenville acknowledges that environmental, social and governance (ESG) impact is hard to measure, but it’s not impossible. Howard-Grenville says that companies need to do a better job of measuring outcomes to give a greater understanding, insight, and even purpose, and when necessary, make course corrections in our actions.

Specifically, she identifies the need to ‘zoom in’ to develop insights on processes and to ‘zoom out’ to see broader systems, and value curiosity and learning.

Environmental, social and governance practices also impact on a firm’s reputation. Interestingly, public criticism during crises can prompt innovation in ESG practices, however, many firms get caught in a downward spiral, wherein negative reputations can constrain access to the very resources needed for reform.

PhD Candidate Nareuporn Piyasinchai and Professor Matthew Grimes‘s research suggests that improvements in corporate communication and reporting, and building trust and strong relationship with key stakeholders particularly during crises, is as important as firms’ efforts to invest in sustainability practices.

More from Cambridge Judge on sustainability in business

Insight

Sustainable accounting

David Pitt-Watson, who has been Pembroke Visiting Professor of Finance and Visiting Fellow at Cambridge Judge, talks about a campaign to stop companies benefiting from 'stranded assets' that unduly inflate profits.

Insight

A hybrid approach

Companies should engage with supply chains on sustainability through leveraging a 'spectrum' of approaches, says a new guide for procurement professionals developed at Cambridge Judge Business School.

Faculty news

Circular but costly

Circular supply chains are more sustainable, but they will be rare unless consumers compromise on cost, says a new Harvard Business Review article by Khaled Soufani and Christoph Loch of Cambridge Judge Business School.