Unlocking financial regulatory innovation through the Regulatory Cambridge Genome Project

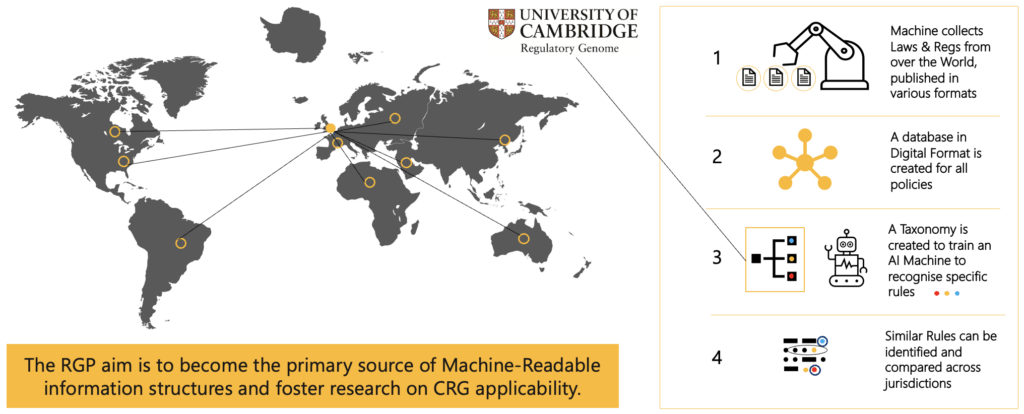

The Regulatory Genome Project (RGP) stands as a collaborative initiative forged in response to the dynamic shifts in technology and socio-political landscapes. Financial regulations have evolved considerably, becoming notably intricate due to diversified markets, financial products, and jurisdictions. This complexity has resulted in various approaches to sharing regulatory obligation information among stakeholders, posing substantial challenges for regulatory bodies and the entities under their purview. In acknowledgment of this, the RGP emerged as an innovative solution.

Our mission

The Cambridge Regulatory Genome (CRG). At the forefront of the RGP’s mission is the development and advocacy for the adoption of the Cambridge Regulatory Genome (CRG). This meticulously designed open information structure aims to streamline the organization and comparison of regulatory obligations across jurisdictions. Our core objective is to dismantle barriers hindering innovation by establishing a common information structure conducive to transformative technology and innovative practices within the financial landscape.

The genesis of the Cambridge Regulatory Genome (CRG)

Developed by Cambridge Judge Business School, the CRG evolves continuously as a machine-readable information structure classifying regulatory obligations. These obligations are grouped into jurisdiction-agnostic taxonomies based on regulatory themes, forming foundational comparative analysis tools. Additionally, the CRG offers flexibility through extensions and commits to providing open access to this valuable resource.

Introducing the RGP at the University of Cambridge

Fostering adoption of the CRG: A community effort

The taxonomies within the Cambridge Regulatory Genome are designed to be publicly accessible. This transparency aligns seamlessly with our mission of promoting widespread adoption, offering 2 pivotal advantages:

- The dynamic taxonomies: The taxonomies are not static entities. Deployed at scale, they give rise to a network effect, creating a robust feedback loop that allows the taxonomies to evolve and adapt over time, ensuring their perpetual relevance.

- The power of shared information: Widespread adoption of a shared information structure catalyses the development of interoperable Regulatory Technology (RegTech) ecosystems. Such ecosystems are ideally equipped to create regulatory applications that cater to the evolving needs of both regulatory authorities and the firms they regulate.

The Regulatory Genome Project (RGP) actively fosters the adoption of the CRG through 2 pivotal pillars:

Building an RGP regulator community

Learn more about the RGP Regulator Engagement Programme, an open invitation extended to the financial regulator community. Be a part of shaping the future of regulatory innovation.

Building an RGP industry community

Join our initiative to strengthen industry participation. Together, we can shape the future of the financial landscape, making it more efficient, innovative, and globally interconnected.

Through the collaboration of regulators, policymakers, and industry stakeholders, a shared journey is initiated to unlock innovation in financial regulation. This collective effort not only mitigates inaccuracies in AI and machine learning models but also drives the progression of RegTech, SupTech, and machine-readable rulebooks. The ultimate result holds the potential for a significant reduction in compliance costs and a substantial improvement in efficiency throughout the entire financial sector.

How the RGP emerged. The birth of an opportunity

The inception of the RGP emerged in early 2020 as a response to a significant need within the financial regulatory landscape. A pioneering research project initiated at the Cambridge Centre for Alternative Finance (CCAF) in 2018 set the groundwork by introducing a pilot software tool. This innovative tool aimed to provide streamlined insights into regulatory obligations for fintech firms across various countries. The scope expanded in 2019, catering to regulatory bodies engaged in benchmarking exercises to inform policy development.

However, progress uncovered a fundamental obstacle hindering innovation in regulatory tools and applications. It became apparent that the absence of a standardised information structure, capable of representing regulatory data in machine-readable form, posed a significant challenge. In response, the RGP was established, leveraging foundational technology to develop the Cambridge Regulatory Genome (CRG).

Building the CRG framework alone is not the complete solution. Recognising the critical importance of not just creating but actively promoting the adoption of this framework, the University of Cambridge laid the groundwork for the RGP. This initiative represents a collaborative effort among organizations equipped to engage both regulatory and industry communities, united in their commitment to establish the CRG as an industry standard.

At the heart of our mission lies a dedication to collaborating on cutting-edge research initiatives that directly address the challenges faced by industries today. We are actively engaged in exploring and solving complex industry challenges, seeking solutions that drive innovation and progress. Our commitment extends to open discussions on research projects tailored to industry needs, offering training that amplifies industry capabilities, and fostering an ecosystem where industry-aligned solutions thrive:

- Research projects addressing industry challenges: We’re open to discussing research initiatives that align with industry challenges highlighted earlier, aiming for solutions that benefit the industry.

- Engaging in industry-aligned research projects: We’re enthusiastic about undertaking research that resonates with the industry, aiming to deliver solutions that strengthen and enhance the industrial landscape.

- Training for industry and ecosystem enhancement: We offer training programs crafted to elevate the industry and its ecosystem, providing tools and insights that drive progress and efficiency within the industrial landscape.