Research centre news

Survey: fintech industry embraces inclusive growth

Co-published by the Cambridge Centre for Alternative Finance (CCAF) and the World Economic Forum, a new edition of the Future of Global Fintech report draws on a survey of nearly 250 fintech firms, providing relevant data from 6 regions that can be used to guide approaches and policies that support fintech growth. Explore the key takeaways from the report, as discussed at the Annual Meeting of the New Champions 2025 in June.

AI and technology

From innovation delta to regulatory singularity: how innovative regulatory systems can help regulation keep pace with financial innovation

The global financial system is undergoing a profound transformation driven by digital innovation. Yet, the pace of regulatory innovation and the scale of digital transformation within public authorities remain uneven and comparatively insufficient. This article, by Bryan Zhang, Co-Founder and Executive Director of the Cambridge Centre for Alternative Finance, examines the widening innovation gap between innovators and regulators, and outlines potential strategies to foster and accelerate system-level innovation within central banks and financial regulators across both developed and developing economies.

Finance and accounting

Transition finance: bridging the climate investment gap

Philippa Martinelli, Head of Climate & Transition Finance at the Cambridge Centre for Alternative Finance, explores the vital role of finance in tackling climate change. The article highlights the scale of the challenge, the urgency of transition finance, and the investment shifts needed to build a low-carbon, resilient global economy.

Finance and accounting

Data sharing as the way forward

In this article, Bryan Zheng Zhang (Executive Director and Co-founder of the Cambridge Centre for Alternative Finance) and Pavle Avramovic (Head of Market & Infrastructure Observator at the Centre), highlight how open banking and open finance are reshaping global financial services through secure data sharing. With over 95 countries adopting frameworks, the shift is delivering benefits for consumers and SMEs, while becoming a key layer of digital financial infrastructure – despite ongoing challenges around privacy, regulation and implementation.

Finance and accounting

From automation to autonomy: the agentic ai era of financial services

In this article by Bryan Zhang (Executive Director, CCAF) and Kieran Garvey (AI Research Lead, CCAF), they explore how agentic AI – capable of autonomous decision-making – could transform financial services by automating workflows, personalising advice, and reshaping roles, while also raising critical challenges around governance, fairness, and risk in an increasingly AI-driven economy.

Research centre news

Cambridge study: sustainable energy rising in Bitcoin mining

The use of sustainable energy sources for Bitcoin mining has grown to 52.4%, while natural gas has replaced coal as the single largest energy source, finds a new study by the Cambridge Centre for Alternative Finance (CCAF) at Cambridge Judge Business School.

Research centre news

New study: industry associations boost fintech ecosystems

Industry associations are valuable contributors to the fintech ecosystem in many jurisdictions globally. They play an important and prominent role in a number of the fintech ecosystems enablers. For example, through representing the voice of the fintech industry, they engage with financial authorities to provide input and feedback on the regulatory environment.

Research centre news

New report: digital finance linked to MSME growth

Digital finance providers enhance access to credit for businesses, particularly for MSMEs operating in EMDE countries, resulting in improved business performance, a new report by the Cambridge Centre for Alternative Finance (CCAF) reveals.

Research centre news

Report: exploring wholesale central bank digital currencies

Report by the Cambridge Centre for Alternative Finance based on interviews with central banks and market participants examines how wholesale central bank digital currency initiatives are evolving in pilots and other developments around the world.

Research centre news

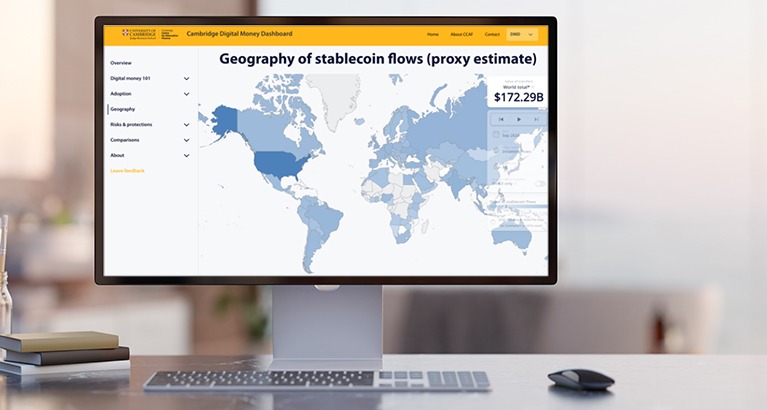

Digital tool sheds light on stablecoin flows and regulation

The Cambridge Centre for Alternative Finance (CCAF) at Cambridge Judge Business School launches an update to the Cambridge Digital Money Dashboard (CDMD), offering new insights into the geographical flows of stablecoins, as well as regulatory overviews for a wider set of jurisdictions.

Research centre news

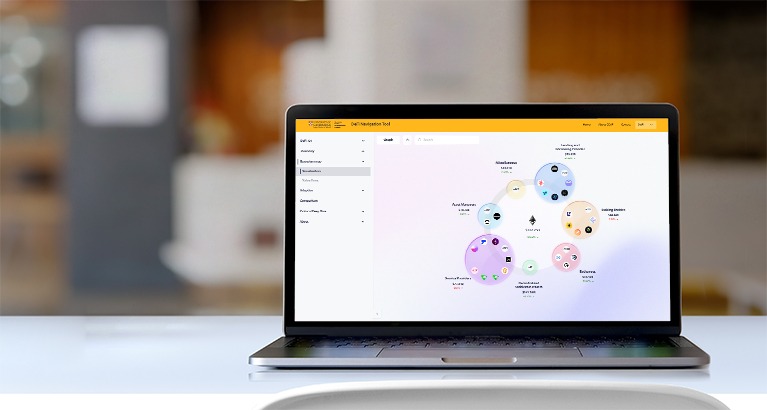

Cambridge launches digital tool to analyse decentralised finance

The Cambridge Centre for Alternative Finance (CCAF) at the Cambridge Judge Business School reveals the Cambridge DeFi Navigator (CDN) to provide empirical data and analysis on the decentralised finance (DeFi) ecosystem.

Research centre news

Open banking and finance gain global momentum

The global adoption of open banking and open finance continues to gain momentum, with both regulation-led and market-driven frameworks fostering greater access and innovation in financial services, a new report by the Cambridge Centre for Alternative Finance (CCAF) reveals.